views

Azad Engineering IPO Allotment Status: Aerospace components and turbines manufacturer Azad Engineering launched its initial public offering (IPO) on December 20. The Azad Engineering IPO received strong investors’ demand as the issue was subscribed 83.04 times during the bidding period which ended on December 22. Azad Engineering IPO allotment has been finalised and investors can now check their allotment status online.

Bidders are expected to get the messages, alerts or emails for debit of their funds or revocations of their IPO mandate by Wednesday, December 27. The primary offering of the Sachin Tendulkar-backed company received a strong response from investors during the bidding process.

The IPO listing will take place on December 28 on both BSE and NSE.

Azad Engineering IPO registrar is Kfin Technologies Ltd. Applicants in the public offer can find out if they have been issued shares, through the basis of allotment. The number of shares allotted can also be seen in the IPO allotment status.

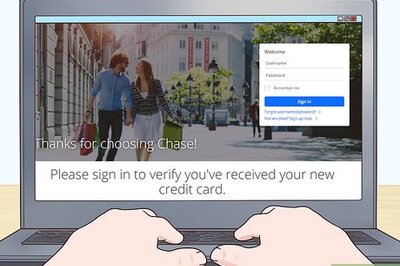

Azad Engineering IPO: How To Check Allotment Status

The IPO allotment status can be checked by following these steps:

1) Go to the official BSE website via the URL —https://www.bseindia.com/investors/appli_check.aspx.

2) Under ‘Issue Type’, select ‘Equity’.

3) Under ‘Issue Name’, select ‘Azad Engineering Limited’ in the dropbox.

4) Enter your application number, or the Permanent Account Number (PAN).

5) Then, click on the ‘I am not a robot’ to verify yourself and hit ‘Search’ option.

Your share application status will appear on your screen.

You can also visit direct KFin Tech portal — https://rti.kfintech.com/ipostatus/ and check Azad Engineering IPO allotment status.

Azad Engineering IPO GMP Today

Azad Engineering IPO GMP today is Rs 305 per share, as per market observers. This indicates that the Azad Engineering shares are trading higher by Rs 305 apiece in the grey market than their IPO price.

Considering the GMP today and the issue price, Azad Engineering shares estimated listing price is Rs 829 apiece, which is at 58.21% premium to the IPO price of Rs 524 per share.

Comments

0 comment