views

Making Sense of Business Taxes

Understand the pass-through business idea. Some businesses are considered to be pass-through structures, which means the business's income passes through the business structure directly to the individual owners. If your business is a pass-through business, it will not be taxed at a corporate rate. Instead, your business's income will be taxed at your individual income tax rate. Pass through businesses always include sole proprietorships and S corporations. In addition, if you have a limited liability company (LLC), you can choose whether it will be pass-through or not.

Explore the federal individual progressive tax rates. Each year the Internal Revenue Service (IRS) adjusts tax provisions in order to create tax brackets and rates you will use to calculate your federal income tax liability. If you run a pass-through business, your tax rate will be determined by your filing status and your individual income, which will include income from your business. For example, in 2013, if you filed as single, your tax rate would have been: 10% if your income was between $0 and $8,925 15% if your income was between $8,925 and $36,250 25% if your income was between $36,250 and $87,850 28% if your income was between $ 87,850 and $183,250 33% if your income was between $183,250 and $398,350 35% if your income was between $398,350 and $400,000 39.6% if your income was over $400,000

Examine the federal corporate progressive tax rates. If your business is not a pass-through entity (i.e., if you have a C corporation), you will be taxed based on the current IRS corporate tax rate schedule. For example, in 2013, the corporate tax rates were: 15% if your income was between $0 and $50,000 25% if your income was between $50,000 and $75,000 34% if your income was between $75,000 and $10,000,000 35% if your income was above $10,000,000

Recognize alternative minimum tax (AMT) liability. The AMT applies to pass-through businesses that have a particularly high income level (the amount will vary from year to year). The AMT exists because these businesses were often able to greatly reduce their tax liability by taking certain tax benefits. Therefore, the AMT was put in place to make sure taxpayers in these situations paid their fair share of taxes. In 2013, the AMT rate was 26% on the first $175,000 of alternative minimum taxable income (AMTI) in excess of the applicable exemption amount. The rate bumped up to 28% for any AMTI above $175,001. If you are a pass-through business with a high level of income, you might owe AMT. You can get help calculating your AMT by using the IRS's AMT Assistant.

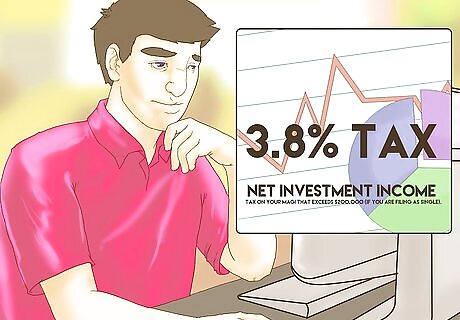

Identify net investment income tax (NIIT). Certain pass-through business income, as well as some dividends paid to C corporation shareholders, may be subject to the NIIT. If you have to File Net Investment Income Tax, it will be because you have net investment income and a modified adjusted gross income (MAGI) above a certain threshold. Net investment income includes interest, dividends, capital gains, income from businesses involved in financial trading, and income from businesses that are passive activities. If you have net investment income, you will only owe the 3.8% tax on your MAGI that exceeds $200,000 (if you are filing as single).

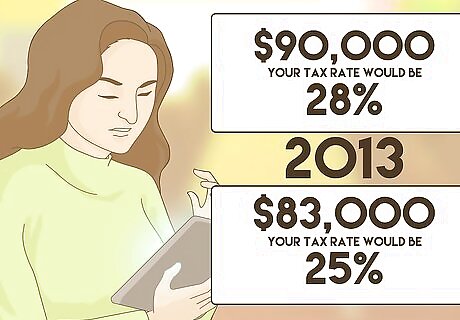

Determine how deductions affect tax rates. The tax rate of your business will ultimately be determined by the interaction between the different taxes and the deductions you are allowed to take. Deductions are expenditures your business takes that can, at the end of the year, be reduced from your overall income. When you take deductions, you are effectively reducing your taxable income, which will in turn influence the tax bracket you find yourself in. For example, assume you own a sole proprietorship and the business has an income of $90,000. If you did not take any deductions in 2013, your tax rate would be 28%. However, if you were able to take deductions and your taxable income was reduced to $83,000, your tax rate would be 25%.

Comparing Effective Tax Rates

Choose how you want your business to be taxed. When determining what type of business you want to start, one of your biggest considerations will be how much tax you will owe. At the end of the day, you want to form a business that works for you and minimizes your tax liability. The first consideration is whether you want your business to be pass-through or not. If you choose a pass-through business (e.g., sole proprietorship, S corporation, or LLC), it will be subject to individual tax rates. If you choose a C corporation, it will be subject to corporate tax rates. When you look at individual tax rates compared to corporate tax rates, you recognize that the highest individual tax rate (39.6%) is higher than the highest corporate tax rate (35%). In addition, the highest corporate tax rate does not kick in unless your business income is extremely high (e.g., over $10,000,000). You can estimate your business income and plug it into each tax schedule to get an idea of what the best choice for you might be. For example, assume you expect your business income to be $45,000. If you chose a pass-through business structure, your tax rate would be 25%. However, if you chose a C corporation, your tax rate would be 15%. In another example, however, assume you expect your business income to be $80,000. If you chose a pass-through business structure, your tax rate would be 25%. If you chose a C corporation, your tax rate would be 34%.

Assess the applicability of additional taxes. Federal tax schedules and rates do not tell the entire story of how much tax your business will owe. If you choose a pass-through business structure, for example, the applicability of the AMT and NIIT could cause you to face a higher effective tax rate than you anticipated. If you are self-employed, you may also owe self-employment taxes. Make sure you consider these other taxes when comparing business structures and tax rates. The NIIT is not applicable to C corporations. There is a corporate AMT, but it does not affect C corporations like the individual AMT does.

Analyze the deductions you will claim. Different business entities can take different types of deductions that will help reduce the amount of tax they owe. Before you start a business, think about what sort of deductions you want to take. Next, look at common deductions for different business structures and determine which deductions fit your needs. As you will see, on average, sole proprietorships deduct far less than corporations. Sole proprietorships often take deductions on individual tax returns for the cost of sales and operations, advertising expenses, car expenses, supplies, and contract labor. In 2010, sole proprietors deducted an average of $40,000 per entity. If you're a sole proprietor, you may owe self-employment taxes. S corporations often take deductions for the cost of goods sold, salaries and wages, the compensation of officers, and rent payments on business property. In 2010, S corporations deducted an average of $1,719,000 per entity. C corporations, like S corporations, often take deductions for the cost of goods sold, the compensation of officers, and salaries and wages. In 2010, C corporations deducted an average of $10,500,000 per entity.

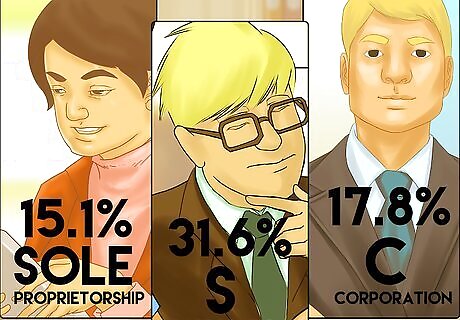

Assess effective tax rates. When you put all of the tax considerations together, you get something called your effective tax rate. Your effective tax rate is the amount of tax you can expect to owe based on all tax factors, not just the federal tax schedules. In 2013, the effective tax rate was 31.6% for S corporations, 17.8% for C corporations, and 15.1% for sole proprietorships. For an in-depth analysis of why the effective tax rates are what they are, read the study contracted by the Small Business Administration. For pass-through entities, your effective tax rate generally corresponds to your relative size. This is why sole proprietorships (i.e., small pass-through entities) have low effective tax rates while S corporations (large pass-through entities) have high effective tax rates. Additionally, even modest pass-through businesses can end up paying high effective tax rates if the business owner is wealthy. This happens because the pass-through business's tax rate is determined by all of the owner's income, not just their business's income. Therefore, a wealthy person who owns a small business might pay more in taxes than a middle-class person who owns the same size business. The average effective tax rate for C corporations (17.8%) includes both the entity level tax and the tax paid on dividends. Therefore, if you are considering a C corporation, you should generally not let the double taxation issue concern you. This is the case because most C corporations do not pay out a significant amount of dividends.

Considering Different Business Structures

Look into sole proprietorships. Sole proprietorships are unincorporated businesses run by individuals. This business structure is one of the most common in the United States. Sole proprietorships are attractive because they are easy to set up and taxes are straightforward. However, sole proprietorships do not offer you any personal liability protection and some tax rates are higher.

Consider LLCs. LLCs are state created business entities that offer the benefits of sole proprietorships and corporations. If you Start an LLC, it offers limited liability and allows you to choose how you want to be taxed. However, you may have to pay self-employment taxes and laws for this type of entity are still evolving.

Examine S corporations. S corporations are incorporated businesses that have the limited liability of C corporations but are taxed like sole proprietorships. However, you can only incorporate as an S corporation if, among other things, you have no more than 100 shareholders, those shareholders are only certain types of people and entities, and you only have one class of stock.

Explore C corporations. C corporations are the most common type of incorporated entity. These businesses offer limited liability and tax rates that do not go as high as individual tax rates. If you want to Form a Corporation you will also be able to take deductions you would not be able to take as another business structure. However, corporations are effectively taxed twice. You will be taxed once at the corporate level and the shareholders will be taxed again when they receive distributions (e.g., dividends).

Comments

0 comment