views

Depositing a Check Using Your Smartphone

Check the phone requirements. Not every bank supports every phone or operating system. The most commonly supported systems are Apple phones and Android phones. Check with your bank to make sure your phone is supported.

Enroll in the program. Just like online deposit, you likely need to enroll in the program to deposit a check. However, often if you enroll in one, you are enrolled in the other. Even if you don't need to enroll in the program, you will need to download the mobile app to your phone. You should be able to find your bank's mobile app in the app store by searching with its name.

Endorse the check. Sign the back of the check with your name. You may also need to add the bank account number or your member number, depending on the bank. Check with your bank for the requirements. Be sure to keep your endorsement in the space assigned to it on the back of the check.

Log into your account. Select the mobile banking app on your phone. Once it opens, log into your account.

Find mobile deposit. Your mobile banking account will have many options, including viewing your bank accounts. Find the area for mobile deposits. It should be on the main screen, but it also may be under a heading such as "Tools" or "Deposits."

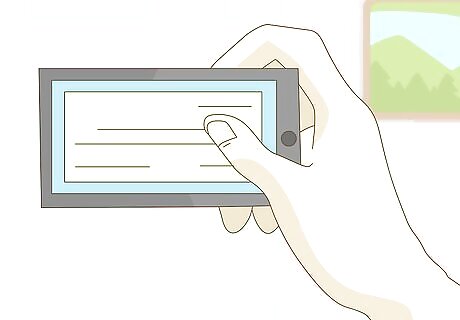

Use your phone to take pictures of the check. Following the directions on the screen, take pictures of the front and back of the check. Usually, the app will require you to accept the picture of the front before moving on to the back, meaning you may need to take each picture more than once to get it right. Some applications automatically detect the check, as long as it is on a dark background. Try to capture the whole check, and line up the check as squarely as possible.

Enter or confirm the amount. Some banks will ask you to type in the amount of the check. Others will just ask you to verify the amount the software automatically pulled from the check. Make sure they match up.

Submit the check. Once you have the photographs and amount correct, submit the check. You may need to wait for the check to be reviewed. Other banks will deposit the amount instantly. Check with your bank to find out its policy. Look for a confirmation email to let you know your check was deposited. If you don't receive an email within a day or two, check your account for the deposit. If it's not there, contact your bank.

Void the check. When you receive confirmation the check was deposited, write "void" or "processed" on it according to your bank's policy. Most banks ask that you keep the check for a certain amount of time, such as 2 months.

Depositing a Check Online

Check if your bank offers online deposit. Most national banks offer this feature, though some local banks do not. You should be able to find information about this feature on your bank's website. Some financial institutions only offer remote check deposit capture to clients with business checking accounts or accounts with high minimum required balances. Be sure to check what your bank requires. Other banks may require that you pass certain credit checks before being able to use this feature.

Enroll in the program. Your bank may require you to enroll in the online depositing program. This step is required usually if your bank wants you to pass a credit check first.

Locate a scanner. Generally, it's safer to use a scanner in your own home, but you can also use a scanner at a library or at work. Basically, you need to be able to scan the check into your computer. The bank will use this scan to read the check, so it must be clear.

Endorse your check. Most banks require that you at least sign the back of the check to endorse it. Sign on the back of the check in the endorsement area. Others require you to add the account number for the account you want to deposit the check into. You also write this number on the back of the check in the designated endorsement area. You may also need to add your member number, depending on the bank. For instance, Digital Federal Credit Union requires a member number.

Pick the correct account. Go online to your bank's website. Log into your account. Find the deposit online portion of the website, which is usually under the account tools. Pick the account you want to deposit the check to, which you will likely find in a drop-down menu.

Pick a scanner. Most banks will ask you to pick a scanner. Usually, you will only have one scanner hooked up to your computer, so this choice shouldn't be difficult. If you have more than one, make sure you are picking the correct scanner and that it is turned on. You can find the name on the front or top of the scanner.

Scan the check. Use your scanner to scan the front and back of the check. Normally, the bank's software will initiate the scan as you click through the process. Some banks may require the checks to be perfectly square on the scanner, so you may need to adjust or re-take the scan according to your bank's guidelines. In fact, some banking software will analyze the image to make sure it's correct before you submit it. Some banks require that your computer be connected to the scanner while you're logged in. In other words, you can't save a picture of the check for later. On the other hand, some banks let you upload pictures of the check, even if they are from earlier. Check your bank account to find out what your bank allows.

Add the amount. Though not all banks require you to do so, you may be asked to type in the amount. Simply type the amount the check is made out for in the box.

Click submit. Most checks are reviewed after being submitted. Some banks deposit the amount the next day, while others do it instantly. You should check with your bank to see how long it takes to credit your account. If yours does not deposit automatically, you'll likely need to wait for a confirmation email. If you don't get an email, check your account for the deposit. If it's not there, contact your bank by phone.

Void and destroy the check. Different banks have different recommendations for what to do with the check after you are done. Some want you to write "void" on the check, while other prefer "processed." Definitely wait for confirmation that the check was deposited before performing this step. In addition, some banks request that you keep the check for at least 2 months before you destroy it.

Comments

0 comment