views

X

Research source

Obtaining TAN Registration

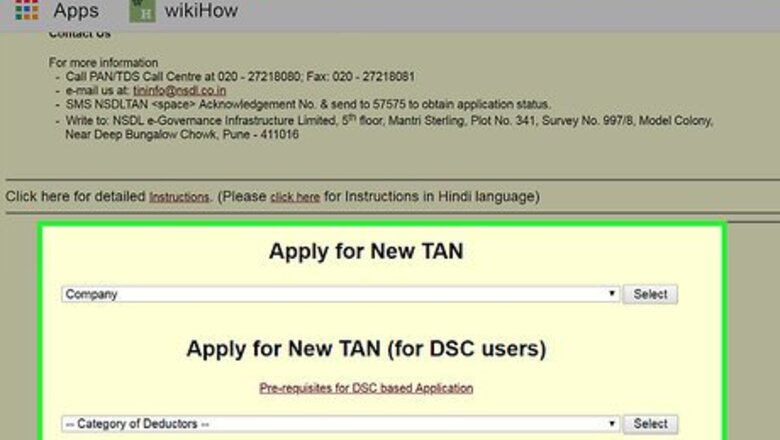

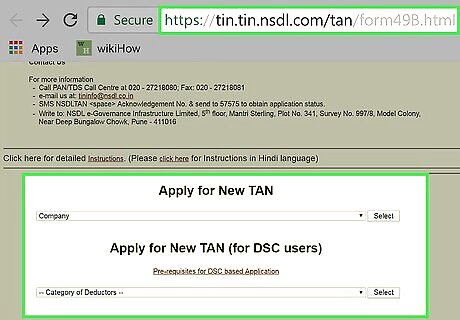

Apply for a Tax Deduction Account Number (TAN). You must have a TAN to deduct income tax from your employees' paychecks. Use Form 49B to apply. You can complete the form online, or you can print it and mail in a paper form. If you want to apply online, visit https://tin.tin.nsdl.com/tan/form49B.html to start your application. You can download the paper application at https://www.incometaxindia.gov.in/forms/income-tax%20rules/103120000000007919.pdf. The processing fee for your application is Rs. 65.00 as of 2018. You can pay using demand draft, check, credit or debit card, or net banking. If you pay using a credit or debit card, there may be additional fees.

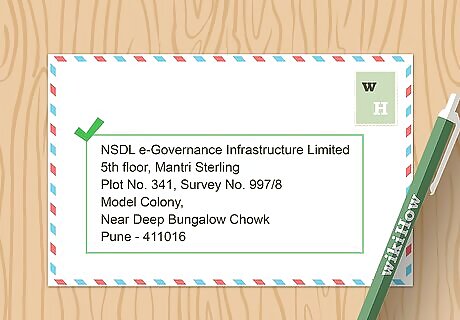

Complete your acknowledgement form. When you complete and submit your online application, you'll be taken to an acknowledgement screen. This screen displays a 14-digit acknowledgement number, your name, contact information, and the status of your application. Print at least 2 copies of this screen (one to submit to the Income Tax Department and one for your records). If you decided to print and mail in a paper application, the verification and acknowledgement is the second page of your application. Sign and place your left thumbprint in the space provided in the presence of a notary. The notary will verify your identification and notarize the document with their signature and seal. Send your application or acknowledgement form along with your payment for the processing fee to NSDL e_Governance Infrastructure Limited, 5th floor, Mantri Sterling, Plot No. 341, Survey No. 997/8, Model Colony, Near Deep Bungalow Chowk, Pune – 411016.

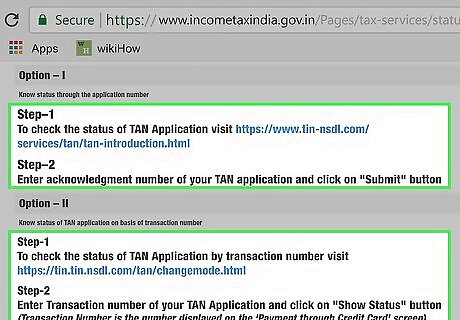

Receive your TAN in the mail. Your TAN will be allotted by the Income Tax Department and sent to the address you listed on your application. Expect this to take several weeks. You can check the status of your application online. To check the status of your application, go to https://www.incometaxindia.gov.in/Pages/tax-services/status-of-tan.aspx. You will need either your acknowledgement number or your transaction number to track your application.

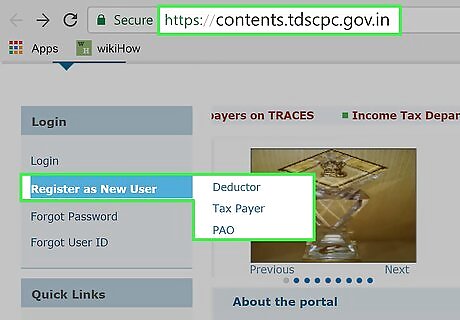

Register your TAN with the Income Tax Department. Before you can deduct income tax from your employees' salaries, you must register as a tax deductor. Go to https://nriservices.tdscpc.gov.in/nriapp/login.xhtml and click on "Register as New User" to set up your account. Provide the necessary information and create a user name and password. On the next screen, you'll have the opportunity to check over the information you provided and make sure it's correct. If you made a mistake, you can edit. An activation link will be sent to the email address or mobile phone number you provided.

Computing TDS on Salary

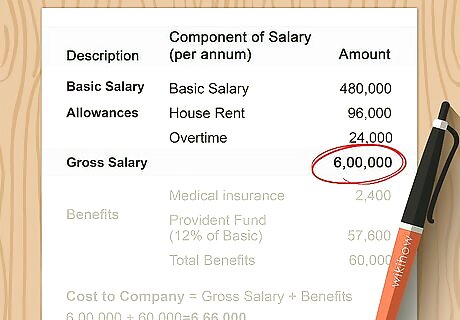

Calculate each employee's total earnings. Total earnings include each employee's base salary, plus allowances and perquisites. Perquisites include the value of any facilities or other benefits provided by you to your employees, such as canteen, hotel, or fuel expenses. TDS is calculated based on yearly income. You can also total monthly income and multiply by 12 to get the yearly amount.

Collect exemption declarations from employees. Employees can claim a portion of their income is tax-exempt based on investments made, travel and housing allowances, or medical allowances. To be eligible for the exemption, your employees must declare the amounts in a written statement and provide proof of their expenses. Some investments also qualify for exemption. These include investments in mutual funds, National Savings Certificates, and life insurance premiums. Each employee can declare up to Rs. 1,50,000 as tax-exempt annually. It is up to you as the employer to review their declarations and proof and determine which exemptions they are eligible for.

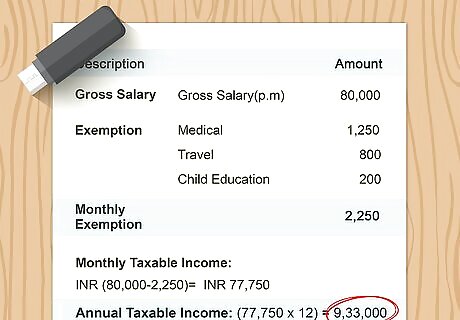

Determine the amount of taxable income. Subtract the total exemptions each employee is claiming from their total income (either monthly or annually) to get the amount of their income that is subject to tax. If you're using a monthly income figure, don't forget to multiply the amount by 12. For example, you pay an employee Rs. 80,000 a month. They claim monthly exemptions of Rs. 1,250 for medical allowance, Rs. 800 for travel allowance, and Rs. 200 for child education allowance, for a total monthly exemption of Rs. 2,250. Their monthly taxable income is Rs. 77,750. Multiply this number by 12 to find an annual taxable income of Rs. 9,33,000.

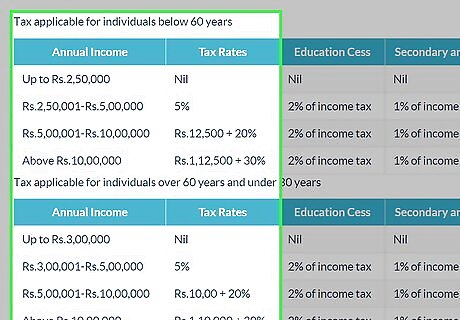

Consult rate tables to find the applicable tax rate. Generally, there are 3 tax slabs. If an employee earns Rs. 2.5 lakhs or less, their entire income is exempt. Otherwise, you will deduct a percentage of their income for taxes from each paycheck. Employees making between Rs. 2.5 lakhs and Rs. 5 lakhs are taxed at 10 percent. If they earn between Rs. 5 lakhs and Rs. 6.33 lakhs, they are taxed at 20 percent. Any greater income is taxed at 30 percent.

Use the online calculator at the Income Tax Department website. Once you've calculated TDS on salary yourself, you may want to check your figures using the official online calculator. Go to https://www.incometaxindia.gov.in/pages/tools/tds-calculator.aspx to use the calculator. The calculator will get you the most up-to-date rate for each year. You can also calculate TDS for previous years, in case you believe mistakes were made on earlier returns.

Filing TDS Returns

Deposit payments the day they are deducted. Each payday, deduct TDS payments as calculated and deposit those amounts to the credit of the Central Government. Payment can be made at RBI or SBI branches, or at any other authorized bank. You must make your payments electronically if your business is incorporated or if your accounts are legally subject to audit. Otherwise, you can pay with check, cash, or bank draft. Provide a TDS certificate to each employee stating the amount of tax that has been deducted from their paycheck.

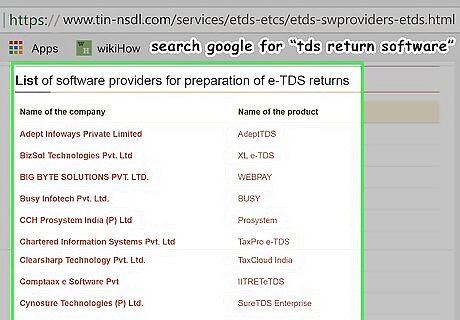

Download electronic return software. Electronic TDS returns must be submitted in a particular data format. The software to produce these returns is available for download online at no charge. You can also use approved commercial software, or hire an accountant to file your returns for you. To download return software and submit your returns yourself, visit the website of the Income Tax Department at www.incometaxindia.gov.in. Software is also available from the NSDL e-Governance Infrastructure Limited website at www.tin-nsdl.com.

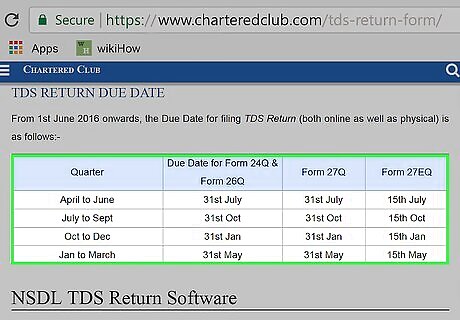

Deliver quarterly statements electronically. Financial-year quarters end on June 30, September 30, December 31, and March 31. Your TDS statement for the quarter is due on the 15th of the month following the end of the quarter, with one exception. The quarterly statement for the quarter ending March 31 is not due until May 15. If you don't file your statement by the due date, you may be charged a penalty. Some small businesses may be able to send in paper statements. However, most employers are required to send electronic statements. The total statements consist of a report form plus your accounting files showing all deductions made for each employee during that quarter. If you upload your TDS files electronically, you'll pay an upload fee of at least Rs. 25 (as of 2018), depending on the number of employees you have. You can also send in a physical copy of your files free of charge. The entire return must fit on one CD.

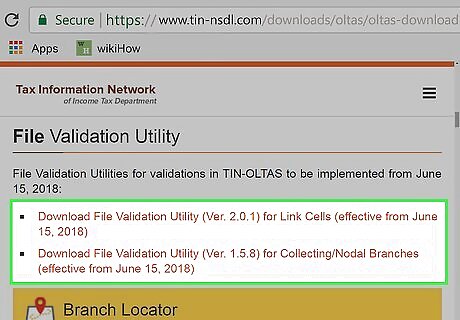

Validate your return. Your return software includes a validation tool that reviews your file for any errors. Read over the report generated and correct any errors found before submitting your statement and file. The validation tool only validates the data structure – it doesn't review your figures. Make sure the figures in your files match the totals you entered on your forms. If they don't match, your returns will be rejected.

Submit your verified declaration. If you submit your TDS returns electronically, you must also send in a declaration of the accuracy of your return. This declaration should be signed in the presence of a notary and include your left thumbprint. The declaration must be made by a person responsible for making the deductions, not the person who completed the returns. This means if you have an accountant who files your returns, you're still responsible for submitting a declaration. So you can also file TDS return via Gen TDS Software before the due date and avoid penalty

Comments

0 comment