views

Working with the Merchant

Gather information about the transaction. Before you talk to the merchant, get all the details and documentation you have for the transaction together, so you can explain exactly how and when the problem occurred and how you'd like it resolved. Along with any email receipts or other information you received from the merchant, get copies of your bank or credit card statements that show the transaction. This evidence is particularly important if your dispute relates to the amount you were charged. If your problem with the transaction relates to the product you were sold being defective or not living up to its description, see if you can find the product's listing on the merchant's website and take a screen-cap. You also may want to take pictures of the item you actually received – particularly if the damage or defect is obvious.

Contact the merchant. Typically you can find a phone number to call with complaints or problems on the merchant's website, or in any email confirmations of your order that you received. Be courteous and respectful to the person who answers the phone. Getting irate or insulting him or her typically won't get the situation resolved any faster. Explain the problem you have with the transaction, providing any details the representative wants that you have available. Depending on the issue you're having, the problem may be a result of a simple clerical error that the merchant is happy to resolve and keep you as a customer. Merchants also don't like to be blind-sided. Even if you aren't able to resolve the problem over the phone, at least the merchant is on notice that you have an issue with the transaction. If you send a letter or take other action, it won't come as a surprise. If you're able to resolve the dispute over the phone, be sure to ask the representative to send you written confirmation of the actions the merchant will take to eliminate the problem.

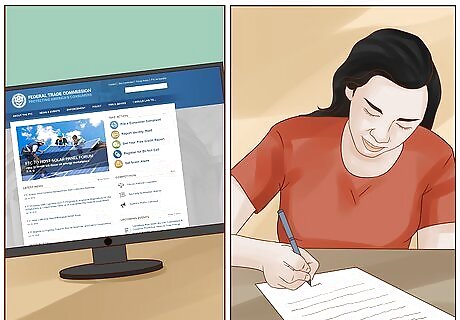

Send written notice. If you are unable to resolve the problem over the phone, write and mail a letter to the merchant detailing the issue you have with the transaction and providing evidence to back up your claim. You may be able to find a sample letter you can use on the website of a government or consumer protection agency such as the Federal Trade Commission (FTC). These sample letters provide the basic format and information that should be included in your letter, although you should adapt it to fit your situation. Include as much information as possible so the merchant can quickly find the transaction or account you're disputing. For example, if you received an email confirmation with a transaction number, include that number in your letter. If you registered for an online account with the merchant, you should include your account information as well. Provide factual details about the transaction and your dispute, and tell the merchant how you would like the issue resolved. Include copies of any documents or other information that back up your points. Give the merchant a deadline to respond, and make sure you've included contact information so the merchant can get back to you. Set your deadline out far enough that the merchant has time to investigate the issue – a couple of weeks should be sufficient. Make a copy of your letter for your records before you send it, then mail it using certified mail with returned receipt requested so you'll know when the merchant receives your letter.

Evaluate the merchant's response. How the merchant responds to your letter will determine your next steps to resolve the dispute. If the merchant is unwilling to work with you, consider taking up the matter with your bank or credit card company. Make note of the date the merchant received your letter, and mark your deadline for a response. You may receive a phone call from the merchant, but typically a merchant will respond to a written letter in writing. If the merchant decides to reject your argument, it typically will send you a letter explaining the reasons.

Get any agreement in writing. If the merchant agrees to work with you and refund any unauthorized or duplicate charges, make sure you receive written confirmation so you can show it to your bank or credit card company if the charge remains on your account. After you hear from the merchant, you'll need to follow up with your bank or credit card company to ensure that the charges are refunded or otherwise removed from your account. In some cases, state or federal law may require the merchant to send confirmation of the dispute resolution in writing. Even if written confirmation isn't legally required, maintaining a written record of any agreement or resolution of the dispute will be essential if there are further problems and you have to prove the terms to which the merchant previously agreed.

Consider filing a complaint. Consumer protection agencies such as the Consumer Financial Protection Bureau (CFPB) exist to assist you if you are unable to resolve transaction disputes or suspect you may be the victim of fraud. The CFPB was created to assist consumers and ensure fairness in financial transactions. The agency has an online complaint center on its website where you can easily file a complaint and get government intervention on your behalf. You also may want to file a complaint with the Better Business Bureau or a local chamber of commerce, particularly if the business is a smaller business physically located near you.

Initiating a Chargeback

Compile evidence of the dispute. Chargebacks typically involve the receipt of faulty or defective merchandise, so you should gather evidence of the product's defects as well as documents such as receipts to prove the transaction amount. Keep in mind that federal chargeback protection only extends to purchases over $50 that are made in your home state or within 100 miles (160 km) of your address. This may mean that chargeback protection isn't available for your internet transaction. However, many banks and credit card companies have their own chargeback policies that provide protection for transactions beyond those covered by federal law. You will need to gather information about the transaction, including any receipts or email confirmations, as well as your bank or credit card statement that shows the transaction you wish to dispute. Keep in mind that the more information you have to support your arguments, the more likely your bank or credit card company will be to side with you.

Contact your bank or credit card company. You can call your bank or credit card company's customer service number to find out more information about its particular chargeback procedure and take the first steps to get that process started. Typically you must demonstrate that you have already made a good faith effort to work with the merchant to resolve the problem, and were unsuccessful. If you previously attempted to negotiate with the merchant and he or she refused to work with you, a copy of the letter you sent and proof of its receipt should fulfill this requirement. Sometimes it just isn't possible to contact the company with which you have a transaction dispute. For example, you may have purchased a subscription through a website that was subsequently taken down, but you are continuing to be charged the monthly rate despite the fact that you're not receiving the product or service you ordered. In this sort of situation, you'll have to explain to your bank or credit card company why it was impossible for you to attempt to resolve the dispute on your own. Most banks and credit card companies allow you to begin the chargeback process over the phone. Call the customer service line and follow the prompts to dispute a transaction or speak directly to a representative. Keep in mind that in most cases you must notify your bank or credit card company within 60 days of the date of the transaction if you want to initiate a chargeback.

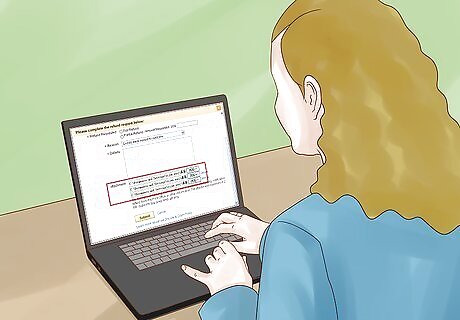

Complete any forms. After it receives your initial request to initiate a chargeback, your bank or credit card company typically will send you forms to fill out with details about the transaction and the reason you're requesting a chargeback. The forms require you to provide written details about the transaction, including the date of purchase, the items or services you purchased, and why you want to refuse payment. Stick to the facts, and keep your answers brief. You also may have to describe any other methods you attempted before requesting a chargeback, and why these methods were unsuccessful. Typically you must attach copies of any documents or other evidence you have to back up your claims.

Wait for the bank's decision. Typically your bank or credit card company will contact the merchant about the dispute after receiving your completed forms. Within two billing cycles, it will determine whether to approve or deny your chargeback request. While you may receive a call from your bank or credit card company, it's more likely that you'll receive a written notice after the investigation is complete. Your bank or credit card company will either return the funds to your account, or send you a written explanation as to why your chargeback request is being refused. Typically, provided you have sufficient evidence of the problem, your bank or credit card company is going to take your side and put the funds back in your account. However, be aware that the merchant may then come after you for the money.

Disputing the Transaction

Log into your account. If you are a member of an online payment service such as PayPal, your account typically will have options for you to dispute a transaction completed using that service. Read about the dispute resolution process before you begin so you understand what will be expected of you. The process may differ depending on the type of account you have. For example, PayPal has a different process for business accounts than it does for personal accounts, even if you have the same role in the transaction. The payment service typically will have a deadline if you want to dispute the transaction. For example, PayPal gives you 180 days from the date a payment is posted to dispute the transaction. Note that this is longer than you might have with a traditional bank or credit card company.

Open a dispute. Follow the prompts on the payment service's website to identify the transaction with which you have a problem and send a dispute notification to the seller. You may have to provide information about the transaction and the reason for your dispute. Typically you will be asked to categorize your complaint, and then you can provide details about the specific nature of the dispute. For example, PayPal provides three categories for disputes: item not received, significantly not as described, or unauthorized transaction. Since the transaction was processed through the payment service, you typically don't have to provide any receipts or other other information about the transaction itself – the payment service already has this information in its records.

Negotiate with the seller. Typically you and the seller will message each other directly, through the site's resolution center, to resolve the dispute you have with the transaction. While you're negotiating, the payment service may put a hold on the disputed funds so neither party can access them. For example, PayPal gives you 20 days from the date you open your dispute to negotiate with the seller. During that time, the company places a hold on the funds. However, if you don't resolve or escalate your dispute before the 20-day deadline is up, PayPal will close your dispute and release the funds to the seller. Typically the seller will get an email notification alerting him or her to your dispute. The seller then has a deadline to respond – usually about a week.

Escalate the dispute. If you are unable to come to a satisfactory resolution of your dispute, typically the payment service provides a means for you to escalate the dispute and get assistance from customer representatives. Keep in mind that if you're disputing a transaction because you haven't received an item, there may be a waiting period before you can escalate the dispute. This period is designed to ensure that you don't get a refund for the product and then receive it the next day. Escalating the dispute brings the payment service in as a mediator between you and the seller. The payment service may ask for additional information from you regarding the dispute, and then investigates the situation.

Wait for resolution. Once the payment service receives your information, a customer service agent will work with you and the seller to resolve the transaction dispute. Typically you can get updates on the progress of the investigation by checking your account. Services such as PayPal usually provide an estimated date by which your dispute will be resolved after receiving your information. The customer service agent working on the dispute will request evidence, such as a shipping receipt, from the seller to demonstrate he or she lived up to his or her end of the bargain. Typically the disputed transaction funds will remain on hold while the customer service agent investigates the situation and works to resolve the dispute.

Share your experience. If you are dissatisfied with the resolution or believe that the seller was unfair or took advantage of you, leave a customer review for that seller so others can learn from your experience. Customer reviews can be powerful. Some sellers may refund money even when they know they were in the right just to avoid the possibility of a negative customer review. If you believe the seller was dishonest, relating your experience to others, either on the seller's website or profile on an online marketing site such as eBay, can serve as a warning. Recognize the power of your review and keep it honest. Avoid stooping to personal insults or disparaging remarks about the seller. Simply relate the facts about what you experienced.

Comments

0 comment