views

- Bring your driver’s license, proof of insurance, and a form of payment. If you want to finance the car, bring paystubs and bank statements, too.

- You might want to bring a military/student ID for a discount, your preapproval loan documents, or your trade-in title and registration if you’re trading a car in.

- You can finance a vehicle through a dealership on the spot or get prequalified for a loan at a bank. The dealership will be easier, but a bank may be cheaper.

- If your credit isn’t great and you’re financing, bring as many bills, bank statements, and payment plan documents as you can to show you’re financially responsible.

Essential Documents

Driver’s license If you’re buying a car, you’ll need to be able to demonstrate that you’re legally allowed to operate one. Bring your driver’s license and make sure it’s valid. This will also be your proof of residency if you’re taking a loan out for the vehicle. Bring your driver’s license even if you don’t know you’re ready to buy yet! You’ll need to present the license if you want to test drive anything. If your current address is different than what’s on your ID, bring some utility bills with you as well. You probably won’t need them, but you may need to prove you moved.

Proof of insurance Bring either your previous insurance card (if your insurer has a grace period for new vehicles), or proof of a new insurance policy. If you already drive, your current insurance almost certainly covers new car purchases, but get new insurance for the vehicle you buy within the next day or so once you buy the car. It’s pretty rare these days for insurance companies to not offer temporary coverage for new vehicles, but you may not have it if you opted for a very specific package. Contact your carrier or insurance agent with any questions.

Form of payment Bring your checkbook or debit card if you’re going to pay cash for the vehicle or put a down payment on your loan. You can also use a credit card if the dealer accepts it (most dealers will, but some of them only let you put a limited amount on a credit card). Even if you’re taking a loan out, you’ll likely want to make a down payment. Some dealers will offer zero-down financing where you don’t pay anything on the day you sign for the car. You can go this route if you really want to, but it’s usually not ideal because the monthly payments end up being a lot larger.

Trade-In Documents

Title and registration for your old vehicle If you’re upgrading your ride by trading your current vehicle in, the dealer will typically make things very easy for you. However, you do need to bring your registration and title to prove that the car is yours.

Financial Documents

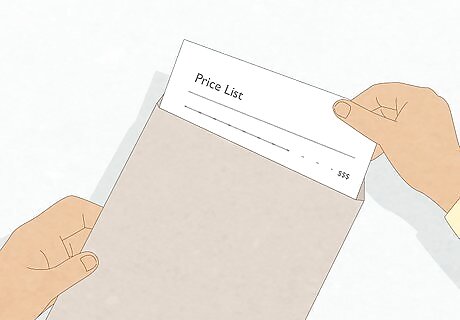

Pre-approval loan documents You don’t need to prove that you’re approved for a loan—the dealership will confirm that themselves—but the preapproval paperwork may give you a little bit of leverage when it comes to negotiating your price. The fact that a bank trusts you to pay back the loan is a strike in your favor, but this also sets a hard limit if you’re buying on a budget, so a dealer is more likely to meet you in the middle. Think about it—if you’re preapproved for $35,000 and you’re looking at a vehicle that costs $36,000, the dealer will be very inclined to take that $1,000 off just to make the deal. This works in the other direction, too. If you’re preapproved for $35,000 and the vehicle you’re looking at is $34,000, the dealer won’t be able to upsell you on additions or packages you don’t need.

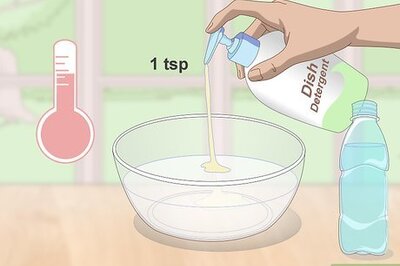

Paystubs and bank statements If you’re going to take out a loan, you’ll need to prove that you’re capable of paying the loan back. Bring paystubs to prove you’re employed and have the income to support a car loan. The dealership may also require bank statements to show you’ve got the savings to make a down payment. If you’re paying for the car outright, you won’t need to demonstrate that you’re able to finance the vehicle.

Military, veteran, or student ID Many dealerships offer discounts for teachers, students, vets, or active military, so bring proof that you fall into one of those categories if it’s relevant. Even if they don’t offer an explicit discount, you can bring it up during negotiation to try and tug on the dealer’s heartstrings! If you’re scoping out a deal, keep an eye out for any unique discounts you may qualify for. Veterans and military folks may get some love on Memorial Day weekend, for example.

What can I bring to help me negotiate?

Bring comparable vehicle listings with you. If you’ve got your heart set on a specific vehicle and you want some negotiating leverage, print out a few similar (but cheaper) listings you find online. Having the listings right in front of you will make it a lot easier to negotiate a better price. For example, if you’re looking at a 2018 Civic that’s selling for $26,000 and you can find some 2017 Civics for $22,000 or a 2019 Civic for $27,000, you could justify a lower bid for your price. Look up the fair value for the vehicle you’re looking at ahead of time by using a site like Edmunds or Kelley Blue Blook. This can help you negotiate if the list price is high.

How do I finance the vehicle?

You can finance a vehicle through a dealership or through a bank. It’s generally easier to finance through the dealership, although you’ll spend a little bit more than you would by finding a loan through yourself. Once you’ve chosen a car and agreed upon a price with the dealer, ask them what kind of rates they offer. Then, contact your main bank or reach out to a local lender and ask them what kind of loan they’ll provide you. Keep in mind, you don’t want to take too long getting loan quotes. Each credit pull puts a tiny dent in your credit, and it can add up if you get more than 3-4 quotes for loans. Your credit score and the market interest rate are the two major drivers of your interest rate. If you’ve got poor credit, you can still get a deal if market rates are low.

What should I bring if my credit is low?

Bring a folder of all of your financial documents with you. There’s no way to know which specific document will help tilt things in your favor when the lender considers your interest rate, so bring as much info as you can, including your W2, tax documents, lender agreements, and payment plan details for any debt you hold. If your credit isn’t the greatest, bring personal references with you so the dealer/lender can do some background research on you. You’re entitled to a free credit report from Equifax, Experian, and/or TransUnion once every 12 months. Pull your credit report before you go to the dealership to see what your score is. If you have a credit score of 600 or lower and you don’t need a car right now, consider spending 6-12 months rebuilding your credit before you apply for an auto loan to get a better interest rate. That way, you’ll pay less for the vehicle.

Comments

0 comment