views

Best Places to Exchange Currency

Banks and credit unions Before traveling, contact your bank or credit union to ask if they can exchange for the currency you need. Exchange rates at banks and credit unions are better than at airports and exchange desks in tourism hotspots, and you can usually place an order over the phone and pick up the money at the branch a few days later. Some banks will even waive the fees if you convert a certain amount of currency. When you return from your travels, your bank may buy back any remaining foreign currency in your possession. Before exchanging, be sure to check the current exchange rates on Xe.com or Reuters. These rates are not the same as those a traveler will receive when exchanging currency; they are interbank rates that banks use as a reference for trading large volumes of currency electronically.

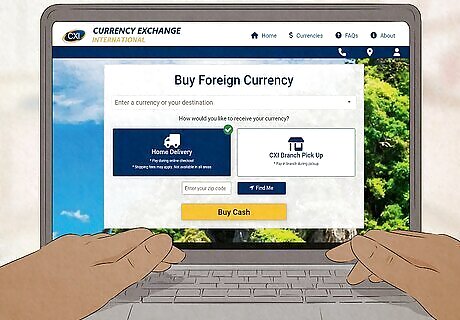

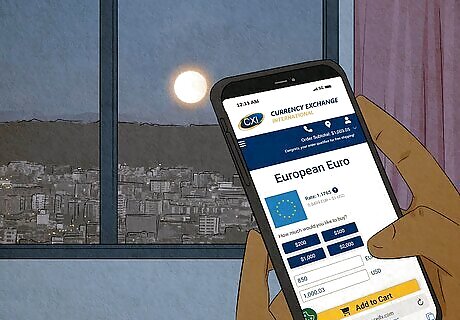

Online currency exchanges Get the foreign currency you need in advance without leaving home using an online currency exchange like Currency Exchange International (CXI). CXI is the largest non-bank foreign currency provider in the US, and they offer online ordering of 80+ currencies with home delivery or branch pickup options for travelers. And it's super easy to use—just visit their website, select the currency you want to buy, and choose whether to pay now for home delivery or pay at the branch during pickup. Currency exchange specialists will also exchange back leftover currency bills at their branches, but typically not coins

ATMs If you're already traveling, you can exchange your money for local currency at an ATM. If you bank with an international bank, look for one of their ATMs at your destination—you can usually withdraw money in the local currency at a competitive exchange rate and much lower fees than an out-of-network bank. If not, you should be able to withdraw money using your debit card at most foreign ATMs, albeit with a higher fee.

Why Bring Foreign Currency When Traveling

Security If your card is lost or stolen in a foreign country, you'll really wish you'd exchanged that cash before you left for your travels! Paying cash abroad also reduces the risk of card skimming and other forms of fraud and prevents you from losing access to your funds if your bank locks your account due to unfamiliar foreign transactions.

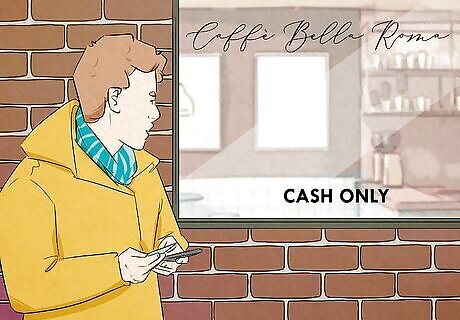

Convenience While your debit or credit card is widely accepted in your home country, it may not be in the country you're traveling to. Everyone takes cash, and plenty of goods and services can only be acquired with cash. Make sure to get foreign currency before traveling so you can pay cash for goods and food from street vendors, tip your drivers, haggle for better prices, and shop at cash-only destinations.

Avoid costly fees Many banks and credit card issuers charge foreign transaction fees for international transactions. If you wind up needing local currency while traveling but didn't plan in advance, you might have to pay high exchange rates to get the money you need or pay hefty fees to use your debit or credit cards.

Why You Should Order Currency Online

Save time Instead of waiting in line at the bank or dealing with the hassle of airport exchange kiosks, order your travel money online from the comfort of your home. Currency Exchange International offers next-day delivery and fast in-person pickup at a local branch.

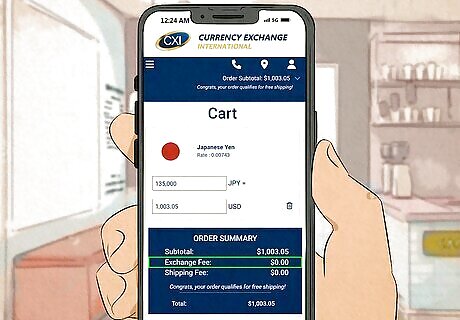

No exchange fees If you place an order with home delivery through Currency Exchange International, you won't have to pay exchange fees at all. And, if your order is for more than $1000, you'll get free next-day shipping.

Wide variety of currencies available Online exchanges, including Currency Exchange International, have more currencies available. CXI, for example, has 80+ currencies, so you definitely won't have to worry about being turned away.

Delivery to your home If you need to exchange currency fast, you can get free next-day delivery for orders over $1000 through Currency Exchange International.

Benefits of Dealing with a Specialist

Currency options Currency Exchange International offers a wider range of currencies, including less common currencies you won't find at your bank. No matter where you're traveling, CXI has you covered.

Competitive rates Because exchange specialists buy in bulk, they can offer better exchange rates than other services. CXI, for example, offers a Best Rate Guarantee, which means they'll meet or beat the exchange rate given by your local bank.

Exchange money on your schedule Unlike your bank, which closes for holidays and has limited daily hours, currency exchange specialists know that your travel money needs don't always align with banking hours. You can exchange currency 24/7 through Currency Exchange International, and they even have in-person branches in major metropolitan locations across the United States with extended and holiday hours.

Mistakes to Avoid

Not exchanging currency in advance. You'll always get better exchange rates and lower fees by ordering foreign currency from a specialist before you travel. Plus, having your destination's currency in your pocket when you arrive ensures you can buy what you need without worrying about whether your card will be accepted.

Exchanging currency at the airport or tourist centers. While it may seem convenient to wait until you're on your way to your destination or arrive at the gate, airport currency exchanges and tourist center exchange kiosks offer higher exchange rates and the highest fees.

Planning to use your home country's cash. While you may have heard that paying for things at your destination with your home currency is easy because it's more valuable, you won't always encounter vendors and service providers willing to accept non-local currency. Merchants will often inflate the exchange rate at checkout, not giving you as much value for your USD.

Relying solely on your credit or debit card. Even if your card has low or no foreign transaction fees, it won't be useful if you want to buy something from a cash-only location. Plus, if you lose your card while traveling and don't have your destination's local currency as backup, you'll wish you planned ahead.

Getting scammed. Exchanging foreign currency at an untrusted location increases the risk of receiving counterfeit cash, inflated rates, and inaccurate exchanges. Always stick to a trusted currency exchange specialist like Currency Exchange International to ensure you get the correct amount of valid travel currency.

Comments

0 comment