views

On 16 October 2022, Finance Minister Nirmala Sitharaman made a statement: “I look at it not as rupee sliding but dollar strengthening.” Needless to say, this statement created a political outrage, with former Finance Minister P Chidambaram sarcastically remarking: “FM said that the rupee is not weakening but the dollar is strengthening. Absolutely true! A candidate or party that lost an election will always say: We did not lose the election but the other party won the election.” This was followed by a barrage of memes making fun of Sitharaman for her statement.

Here, the political parties engaged in political one-upmanship to win political brownie points. Amidst this political battle, the real state of the economy and reasons for weakening of the Indian rupee vis-à-vis the US dollar was ignored. This article endeavours to analyse and verify Sitharaman’s statement and delve upon the US dollar’s northbound journey and whether the Indian rupee has really weakened. In this analysis, the performance of various currencies with reference to US dollar and Indian rupee is considered to understand the real situation.

With the start of the Russia-Ukraine war, the US dollar has strengthened significantly vis-à-vis nearly all major currencies, barring the Russian ruble. Hence for this analysis, the performance of the US dollar and the Indian rupee against various major currencies is taken from the period starting with the Ukraine-Russia war till date. Russia announced the war on Ukraine on 20 February 2022. Due to the war, various currencies, including the Indian rupee, have weakened against the US dollar.

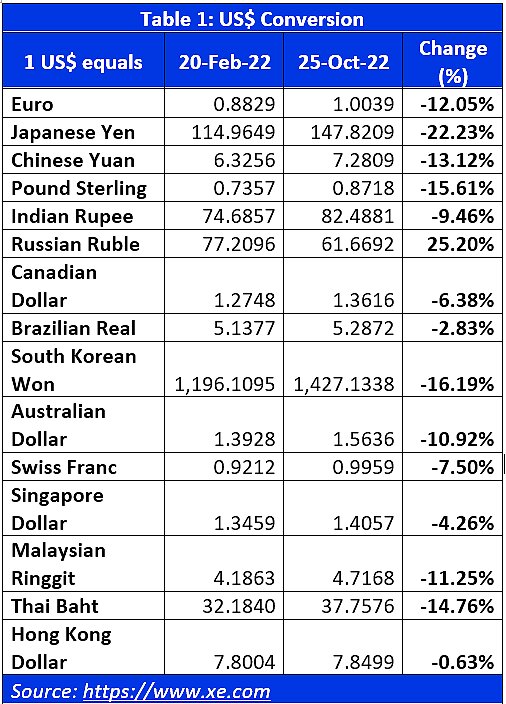

Table 1 hereunder highlights how the US dollar has performed against various major currencies. This table shows conversion value of 1 US dollar into various currencies on 20 February 2022 and on 25 October 2022.

On close observation of the aforementioned data in Table 1, it is visible that except for the Russian ruble, all currencies have weakened against the US dollar. The Russian ruble started strengthening against the US dollar after Russia demanded payment for gas in ruble and demand for ruble shot up as Russia shifted its energy trade from the US dollar to ruble.

All other major currencies have weakened against the US dollar. On analysis of depreciation in value of currencies it is observed that currencies least hurt are the Hong Kong dollar that depreciated against the US dollar by a meager 0.63 percent. The HK dollar is followed by the Brazilian real that depreciated by 2.83 percent, Singaporean dollar that weakened by 4.26 percent, and the Canadian dollar weakening by 6.38 percent. The Indian rupee stood fifth in terms of least weakened major currency that depreciated by 9.46 percent against the US dollar. Major currencies like the euro, the pound sterling, the Japanese yen, and the Chinese yuan depreciated more against the US dollar compared to the Indian rupee.

This is a natural phenomenon that the US dollar becomes stronger during a major global crisis like the ongoing Ukraine-Russia war. Till date, the US dollar remains equivalent to the gold when it comes to protection of value. Hence, in times of gravity, investors continue to prefer the US dollar instead of any other currency. This is not restricted only to trade, but also for parking money in the US or in USD denominated assets and securities. At the moment there is no greater secured avenue of investment, other than gold, that offers the kind of security that the US dollar offers. This is why the demand for the US dollar jumped, resulting in an increase in its value.

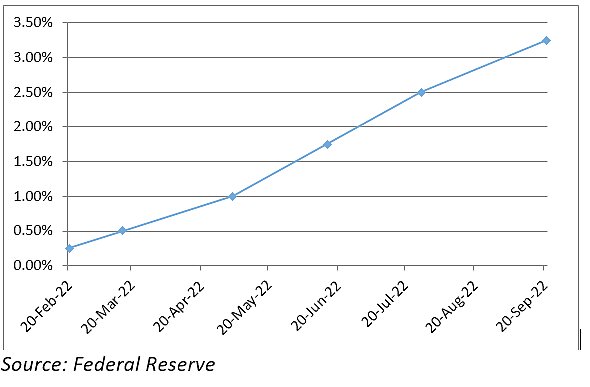

Another reason for the US dollar to strengthen is the Fed rate hikes. The US’ policy rate stood at 0.25 percent for a very long time. Stimulus given during Covid-19 pandemic had brought the country’s policy rates to near zero levels. Then the US Federal Reserve had to start increasing policy rates in wake of rising inflation. Central Banks across the world focus on prudent monetary policy by ensuring that real interest rates remain positive. This means the interest rates must be higher than inflation. With inflation rising in the US, the US Federal Reserve was forced to increase its interest rates. Chart 1, hereunder, highlights the trend of increase in Fed rates from 0.25 percent before the Ukraine-Russia war started to 3.25 percent in a short span of 7 months.

Chart 1: US Fed Rate trend since 20th February, 2022

This increase in Fed rates resulted in capital moving in the US fixed income market and the US securities. This resulted in increased demand for the US dollar, thereby pushing up the value of the US dollar.

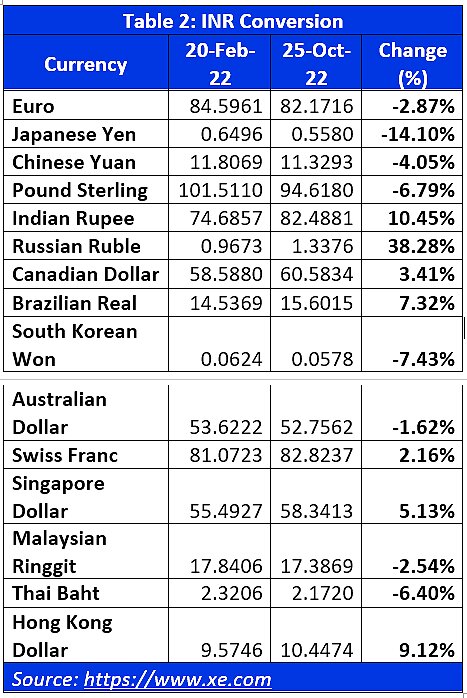

Analysing the Indian rupee’s performance vis-à-vis other major currencies is equally important in understanding what Sitharaman stated. The data is presented in Table 2, hereunder.

After perusing the aforementioned table, Sitharaman’s statement — “Rupee hasn’t weakened” — appears to be true. The euro that was quoting at Rs 84.5961 on 20 February 2022 is now quoting at Rs 82.1716. Rupee has strengthened by 2.87 percent against the euro. Similarly, one Japanese yen cost Rs. 0.6496 on 20 February 2022 and is now costing Rs 0.5580. Thus yen has depreciated by 14.10 percent against the Indian rupee. Even pound sterling that was trading at Rs 101.5110 on 20 February is now trading at Rs 94.6180. Again, the rupee has strengthened by 6.79 percent against the pound. The Chinese yuan depreciated by 4.05 percent against rupee from Rs 11.8069 on 20 February, to Rs 11.3293 now.

Hence, it is visible that when major currencies from the top 10 economies in the world weakened against the US dollar, Indian rupee has weakened less than those large economies. Again, when we compare the performance of the Indian rupee against other currencies, then it is visible that those currencies have weakened against the Indian rupee. This makes it amply evident that the Indian rupee stands on a relatively stronger footing vis-à-vis various other major currencies that have lost heavily against the US dollar when compared to the Indian rupee.

To sum up, Sitharaman was correct in her observation about the performance of the Indian rupee and other currencies against the US dollar. Unfortunately, lack of objectivity in analysing the data and understanding the reasons for cross-currency movements has reduced the discussion on relative strength of the Indian rupee and Indian economy to cacophony and memes targeting the Prime Minister and the Finance Minister. India needs a serious discussion on economics.

Sumeet Mehta is a Chartered Accountant and the author of ‘Diagnosing GST for Doctors’, published by CNBC Books18. He tweets from @sumeetnmehta. Views expressed are personal.

Read all the Latest Opinions here

Comments

0 comment