views

Startups registered with DPIIT will not be subject to assessment proceedings related to angel tax amendments made in Budget 2023. The income tax department last month notified new angel tax rules for evaluating the shares issued by unlisted startups to investors.

While previously, the angel tax, a tax levied on capital received on the sale of shares of a startup above the fair market value, was applicable only to local investors, the Budget for the 2023-24 fiscal (April 2023 to March 2024) widened its ambit to include foreign investments.

As per the Budget, the excess premium will be considered as ‘income from sources’ and taxed at the rate of up to over 30 per cent. However, startups registered by the DPIIT were exempt from the new norms.

To give greater clarity to field officers, the Central Board of Direct Taxes (CBDT) has now issued a circular where it states that in case a DPIIT-recognised startup is picked up for scrutiny on this Angel Tax provision, then no verification of such cases will be done by the assessing officer. The contention of these startups on the issue will be summarily accepted.

Nangia & Co LLP Partner Amit Agarwal said the CBDT circular basically means that startups registered with DPIIT and whose case has been picked up for angel tax issues shall not be subject to any Assessment Proceedings, and AO shall be duty bound to give clean chit to such startups.

The circular provides much-needed clarity with respect to the applicability of Angel Tax on registered startups and is in the nature of administrative guidance to all field officers.

Section 56(2)(viib) of the Income Tax Act read with Rule 11UA of the Income Tax Rules provides that where a closely held company issues shares to a resident investor at a value higher than the face value of such shares, then the excess of the issue price over the FMV will be taxed as income under the head ‘Income from other Sources’.

“Notified entities such as registered start-ups etc. and also venture capital undertaking may not be required to undergo valuation exercise in case where it is receiving investment within a time span of 90 days from the last date of issue of shares,” said tax advisory firm RSM has also said in its note.

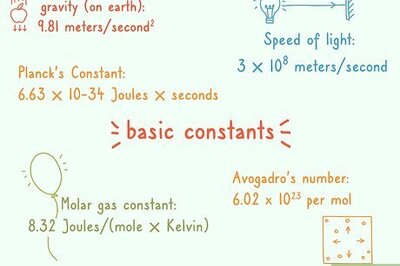

Highlights of the final amended Rule 11UA, are as under:

- Separate valuation mechanism for CCPS has been provided for along with an option to adopt fair market value (FMV) of unquoted equity shares for determining FMV of CCPS.

- For determining the FMV of equity shares issued to resident and non -resident investors, two methods namely – Net Asset Value and Discounted Cash Flow Method, were already prevalent. However, now, for non -resident investors, five more methods – viz. Comparable Company Multiple Method, Probability Weighted Expected Return Method, Option Pricing Method, Milestone Analysis Method and Replacement Cost Methods, have been introduced for valuation of issue of unquoted equity shares or CCPS.

- Price matching facility as per draft rules for both resident and non-resident investors is now extended to CCPS as well. Also, price at which shares are issued to notified non-resident entities / venture capital funds / specified funds shall be adopted as FMV, if receipt of consideration is within a window of 90 days before or after the date of issuance of shares subjected to valuation.

- Valuation report of merchant banker can now be issued up to 90 days prior to the date of issue of equity shares or CCPS for computing FMV for investments by both resident and non-resident investors.

- Safe harbor limit of 10% for valuation of equity shares and CCPS for both resident and non-resident investments, has been introduced.

(With Inputs from PTI)

Comments

0 comment