views

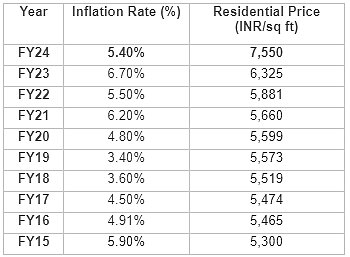

Real estate investors have comfortably beaten inflation that was hovering at high levels in the recent past, especially after the pandemic and the Russia-Ukraine war. According to the latest data from ANAROCK Research, housing prices across India’s top cities have surged at an impressive compound annual growth rate (CAGR) of 13 per cent in the past two years, while inflation has moderated to 5.4 per cent. This surge in real estate prices underscores the sector’s attractiveness as a hedge against inflation.

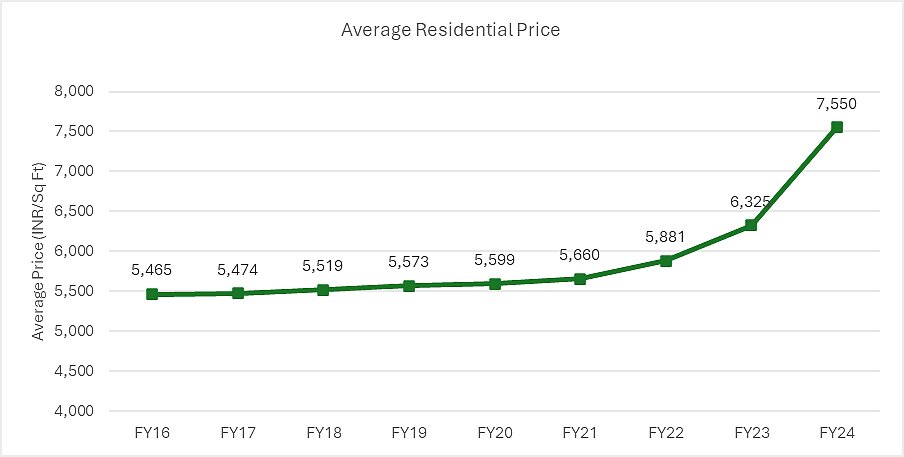

Before 2019, the annual price increase was a modest 1 per cent, with prices remaining relatively stable. However, post-pandemic recovery in the residential real estate market has been robust, driven by a balanced supply-demand dynamic, according to the Anarock report.

Between 2013 and 2020, the top seven cities saw a cumulative supply of 23.55 lakh units against a demand for 20.68 lakh units. Post-2020, demand surged, and available inventory peaked at approximately 8 lakh units by the end of 2016, it added.

“Residential real estate prices have risen continuously since 2013, and in the last two years, appreciated at a CAGR of 13 per cent while CPI inflation moderated by 1.3 per cent on an annual average basis to 5.4 per cent at the end of FY24. This trend signifies a clear outperformance of real estate prices compared to inflation,” according to the Anarock report.

Shobhit Agarwal, managing director and CEO of ANAROCK Capital, highlights the trend, stating, “Since the 2019 elections, average residential prices in the top seven cities have appreciated significantly, growing from Rs 5,600 per square foot in June 2019 to Rs 7,550 per square foot by the end of FY 2024.”

This pattern echoes the post-2014 election period, where average prices in these cities rose over 6 per cent annually, according to the Anarock report.

Real estate has proven to be a reliable hedge against inflation. As inflation erodes purchasing power, real estate investments provide a safeguard, often appreciating in value faster than inflation. This is particularly evident as residential prices have continuously risen since 2013, significantly outpacing general inflation rates.

Real Estate As An Investment

Urbanisation and steady population growth are key drivers of this trend, as increasing numbers of people move to cities for better opportunities, thereby boosting housing demand and exerting upward pressure on prices. Additionally, real estate investments generate rental income, which typically increases in response to inflation, providing a dual benefit for investors.

Fixed-rate financing obtained before inflationary pressures can also enhance real estate investment profitability. As the cost of borrowing rises during inflationary periods, those with fixed-rate loans benefit from lower real borrowing costs.

Agarwal said, “Real estate investments offer diversification benefits within a portfolio. Unlike financial assets such as stocks and bonds, which may suffer under inflationary pressures, real estate provides tangible assets with intrinsic value. Diversifying portfolios with real estate holdings can reduce overall risk and improve long-term returns.”

The rising popularity of financial instruments like Real Estate Investment Trusts (REITs) and inflation-linked bonds further demonstrates investor demand for inflation-protected assets. REITs, which invest in income-generating real estate, offer liquidity and diversification benefits, making them an attractive option for investors.

The sustained appreciation in housing prices, coupled with moderated inflation, highlights the outperformance of real estate as an investment, solidifying its status as a crucial component of a well-diversified portfolio, as per the Anarock report.

According to the latest official data, India’s CPI inflation in May 2024 eased to a 12-month low of 4.75 per cent. In the previous month of April 2024, India’s retail inflation stood at 4.83 per cent.

Comments

0 comment