views

Considering Your Funding Options

Seek franchisor financing. Some franchises will lend you the money needed to purchase a franchise. They can also help you lease required equipment. Not all of them will, and franchisor financing might only be available for newer franchises. For example, you shouldn't expect to buy a McDonald's franchise using franchisor financing. You might also qualify for an incentive program set up for minorities, veterans, or first-time franchisees. These incentive programs might discount the franchise fee or other costs. However, franchisors might want to see that you have a lump sum already saved (not borrowed). You'll need to find the money somewhere.

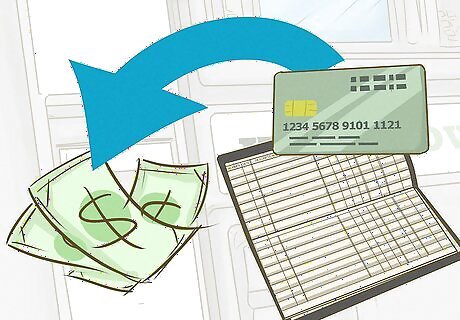

Tap your retirement accounts. You can use retirement accounts such as your 401(k) or IRA to fund the purchase of a business. The process is called a Rollover as Business Startups, or “ROBS.” Essentially, you start a qualified retirement plan in your new business and then rollover your retirement savings into the franchise's retirement plan. The retirement plan then buys shares in your business. If done properly, you won't owe any early withdrawal penalty or taxes on the amount you rollover. If you're interested in a ROBS, then you should work with a company that specializes in the process. Check their fees, which can be hefty. By using your retirement savings in this way, you risk losing all the money you have saved for your retirement.

Pull equity from your home. You can tap the equity in your home with a home equity loan or a home equity line of credit (HELOC). A home equity loan is an installment loan, while a HELOC is like a credit card. Before tapping equity in your home, you need to appreciate the risks. If you default, the bank can seize your home. Generally, you can get about 80% of the equity available in your home.

Find business partners. You might be able to start a franchise without any money if you find partners. These partners will share the costs (and ultimately the profits) of your franchise. Some people approach friends or family, who can provide you with money in exchange for some percentage of ownership in the franchise. You might also partner with someone you went to school with or someone you have worked with before. If you want to go into business with a partner, you should consult with an attorney. You may need to comply with Securities and Exchange Commission regulations. Your attorney can advise you and draft any necessary documents.

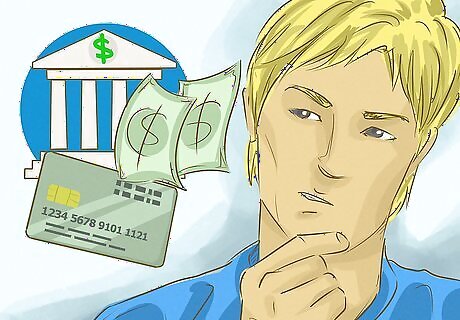

Pursue traditional bank loans. The traditional way to get a loan is to approach a bank or credit union. To get a bank loan, you'll need excellent credit. Also, you probably need at least 20% of the start-up costs in cash, which you might not have. Lenders are more likely to lend if you are buying an established franchise. However, this is a bit of a Catch-22, because few established franchises will let you buy without a down payment. You may need to put up collateral to obtain a loan. For example, you might need to pledge personal assets, such as your home. This means if you default on the loan, then the bank can seize the collateral. Some franchisors also have special relationships with financing companies, which can make obtaining a loan easier.

Consider SBA loans. In the United States, the Small Business Administration (SBA) guarantees loans. Although you obtain a loan from a bank, the SBA guarantees that it will step in and repay the loan if you default. Often, SBA loans are easier to get than conventional loans. The SBA also has a list of approved franchisors. If your franchisor is on the list, you can benefit from a fast application process. SBA loans are still difficult to get. Typically, you need good credit (a credit score of 680 or better). You also need 20-30% as a down payment, so you'll need to find that money somewhere.

Finding an Appropriate Franchise

Research franchise opportunities. There are hundreds of franchise opportunities available in all kinds of industries. You should identify your interests first. For example, you might want to start a restaurant or a gym. Visit your library and pull a franchise opportunities handbook. Flip through it to see what is available. Also look at different franchise websites, such as franchisedirect.com. You can search by category, such as “coffee franchises” or “home-based franchises.” The website should tell you the minimum amount of cash you will need to get started. A franchise exposition might be held near you as well. They are great to visit because you can ask questions and compare franchises at one location.

Check start-up costs. No franchise will let you start for free. However, you can start some home-based franchises for as little as $1,000. Others will cost from $10,000 or more. Find out the start-up costs and whether you can afford to buy in. Before signing a contract, the franchise should give you a Franchise Disclosure Document (FDD), which will explain start-up costs. Item 5 will identify the initial franchise fee, and Item 7 will explain start-up costs such as inventory, equipment, business licenses, signage, real estate, and insurance. You might not get the Franchise Disclosure Document until you submit a qualification questionnaire. However, you should still try to find out the start-up costs before pursuing a franchise. Talk to a current franchisee or ask the franchisor outright how much money is needed. They should be willing to tell you.

Identify what you can afford. After you find the minimum start-up investment, assess your finances to see if you can afford it. Ideally, you shouldn't invest more than 15% of your own money in a franchise. However, this amount can vary depending on your circumstances. It's also a good idea to meet with a financial advisor who can review your financial situation and analyze whether investing in a franchise is worthwhile.

Research the franchise. You only want to work with a franchisor that is reputable. You also want a franchise that is a good fit with you. Accordingly, thoroughly research those franchises that interest you. Focus on the following: Check if there have been any complaints. You can contact the Better Business Bureau and your state's Attorney General's office or consumer protection bureau. Look for complaints that the franchisor doesn't provide franchisees support. Ask about training and support. Some of this information will be in the FDD. One benefit of buying a franchise is that you are taught the franchise's successful methods. Check ongoing costs. For example, you'll probably need to contribute to national and regional advertising. Also, you will need to pay a percentage of your profits as royalties.

Applying for Your Franchise

Clean up your own credit. Franchisors will perform background checks before accepting you. In particular, they will check how diligently you've paid your bills. Accordingly, pull your credit report and fix any errors that might be hurting your credit score. You want your credit score to be as high as possible. However, you might want to avoid paying down any large debts. Instead, hold onto the money, which you can use as your down payment.

Submit a qualification questionnaire. You can signal your interest in pursuing a franchise by completing a questionnaire. The questionnaire will ask for information about your assets, income, and debts. You may also need to provide information about your work experience, education, and motivation for buying a franchise.

Attend a discovery day. Discovery days are a chance for those interested in a franchise to visit headquarters and meet with key business executives. You'll make the most of your discovery day if you come prepared with questions. You shouldn't be pressured to agree to purchase at the discovery day. If you are, then you might want to reconsider. You are being judged just as much as you are vetting the franchisor. Remember to ask intelligent questions. Read the FDD before the discovery day, if you were given it. Be polite to everyone and avoid drinking alcohol at dinners.

Gather financial information. If you choose to pursue a loan, be prepared to disclose all of your financial information. You will need to provide banks with various documents, such as the following: tax returns personal financial statement bank information information about the source of your down payment

Comments

0 comment