views

The court hearings had gone on through all of August. On September 8, 2010, the Bombay High Court was packed to the rafters with newspaper reporters of all hues. There was a battery of lawyers representing the Government of India and telecom giant Vodafone. There were two judges who had been hearing the famous Vodafone tax case: DY Chandrachud and JP Devadhar. Though Devadhar was in Nagpur that day, he was 'virtually' present through a video link. Vodafone’s tax spearhead Desmond Webb was there.

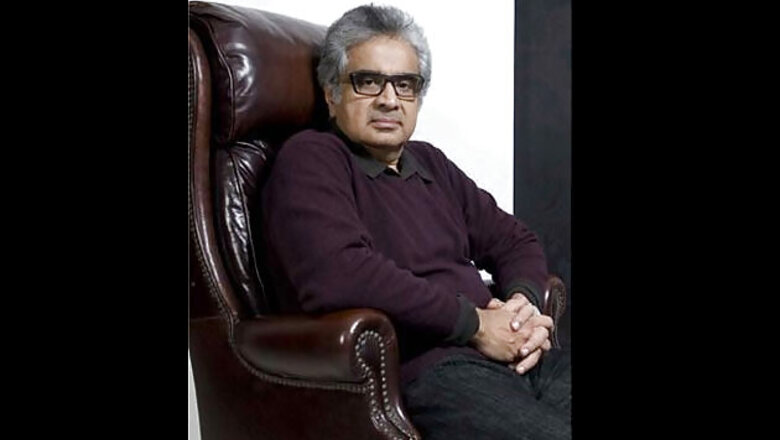

"Most reporters who had covered the hearing passed around early congratulations to us. They believed our counsels Harish Salve and Abhishek Manu Singhvi had done enough for the Bombay High Court to rule in our favour," says a former Vodafone employee who was present in the courtroom.

As the judgement began to be read out, there was some buoyancy in the Vodafone camp. The two judges did not think that Vodafone's purchase of Hutch's business was done in a manner to avoid taxes. The two judges also said that the shares that gave Vodafone control over Hutch's telecom business in India were registered outside the country—in Cayman Islands. And then they turned their attention to the specific issue on which they were supposed to pass a judgement—that Indian tax authorities simply did not have any jurisdiction, any basis to even analyse the transaction. The judges said while they were convinced that Vodafone's transactions were genuine, they were also quite sure that such a complex transaction needed more investigation. This was Vodafone's Javed Miandad moment. The match was lost on the last ball.

"We could not have been more disappointed. Three years had passed by and we had provided so much information and yet the issue was not settled," says a Vodafone executive.

The two people who were slugging it out—Mohan Parasaran on the side of the government and against him Harish Salve who was representing Vodafone—were both not there in the court that day. That would have to wait for another day.

Perhaps no case in corporate history has evoked as much interest as the Vodafone tax case. For all the right reasons, one might add. For the first time in the history of free India, the Indian tax authorities were going after a fat-pursed multinational that had bought a business in India.

In 2006, the Indian mobile telecom market was growing very rapidly. Every month more than 10 million subscribers were signing up to own a mobile connection. If you were a global telecom company, you had to have a piece of the Indian telecom action and you had to buy one of the top firms because in this industry bigger players make more money.

The top dogs in the Indian market then were Bharti Airtel, Reliance Communications and Hutchison Essar. The former two were not selling. Hutchison was owned by the Hong Kong tycoon Li Ka-Shing and he was interested in exiting the business. Vodafone, the British telecom company, wanted to come into India. But others too wanted to buy Hutch to increase their market share. Reliance Communications definitely made a play for the firm. It was a tight finish and on February 12, 2007, Li Ka-Shing accepted Vodafone’s bid and Hutch was sold. That should have been the end of the matter. As things turned out, the sale was just the beginning.

In September 2007, the tax authorities sent a letter to Vodafone. It had just one question for the British firm. Why hadn’t it kept aside money due to the Indian Income Tax Department? The first reaction in Vodafone headquarters was: "Huh? What taxes?" Indian tax authorities were only too happy to point out that while Vodafone and Hutchison Whampoa had done the deal outside India, in effect it involved the sale of an Indian asset—Hutchison Essar India Limited. Since Li Ka-Shing had made such a handsome profit on the sale, he should have given Vodafone the capital gains tax due on the transaction to keep aside for the Indian taxman.

"The only thing that the senior management at Vodafone thought is 'this is absurd!' There is no precedent for this anywhere in the world. Why is the Income Tax Department coming after us?" says a Vodafone senior manager.

What they didn't know then was that one of Income Tax Department's finest minds, Girish Dave, had been thinking about how India could benefit from mergers and acquisitions activity that involved an India angle. Dave retired from the department in 2010, but he was the director of international taxation at Mumbai between 2005 and 2009. That was when he decided to bell the offshore cat.

More surprise was to follow. In the Union Budget of 2008-2009, the government gave a new meaning to something called "assessee in default". Normally, this rule would apply if someone had collected taxes on behalf of the government, but forgot to deposit it with the government. For example, a company that had deducted income tax from its employees' pay, but did not give the government that money. That was "assessee in default" before 2008. But after 2008, even if you were supposed to collect taxes on behalf of the government and had not collected it, you became "an assessee in default". And this change would become effective from June 2002—five years before the Vodafone deal happened.

Sniggering chartered accountants called it the Finance Ministry's "Vodafone Amendment".

Vodafone decided to play the game with all the flair of Alistair Cook. They took the issue straight to the court. That's when Girish Dave's court alter-ego came into being: Mohan Parasaran, the additional solicitor general, Supreme Court of India. This sharp lawyer practiced in the Madras High Court in various branches of law and was also a professor of law at Presidency College. He became what Vodafone claimed about its network: Whichever court the company went to, Parasaran would follow them.

Comments

0 comment