views

Venice: Robot submarines plying the dark, frigid depths of the Gulf of Mexico made halting progress in BP's latest bid to siphon off oil belching from its ruptured wellhead, but tar balls and other debris from the spill posed new threats to the region's shoreline.

While BP Plc inched ahead with its new plan to contain the undersea gusher, the British energy giant saw its battered shares stabilize even as CEO Tony Hayward retreated from yet another public relations gaffe -- apologizing for his widely reported remark that "I want my life back."

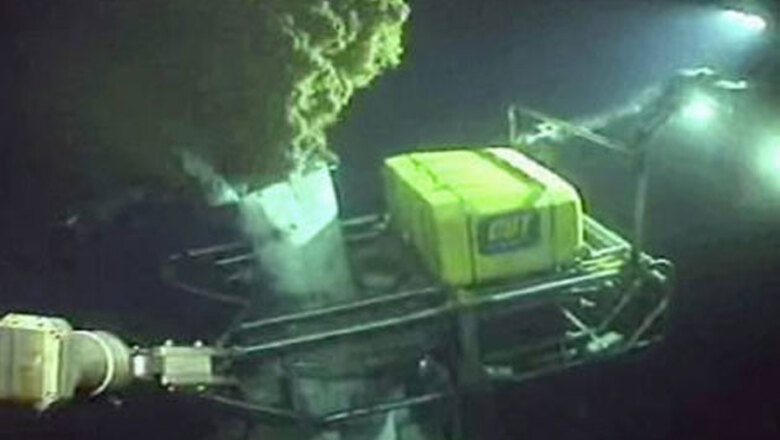

BP's latest attempted fix hit a snag on Wednesday when a diamond-tipped saw got lodged in the deep-sea pipe through which oil is billowing into the Gulf. But BP freed the cutting tool after several hours of tricky maneuvering of its robot submarines, paving the way for the process to continue, a source familiar with the work told Reuters.

The BP oil spill, which began in April, is causing an ecological and economic catastrophe along the US Gulf Coast.

Many thousands of fishermen, shrimpers and other seafood workers have been idled for weeks by government-imposed fishing restrictions that were expanded on Wednesday to cover 37 percent of US federal waters in the Gulf.

In the struggle to minimize shoreline encroachment of oil, Louisiana Governor Bobby Jindal won White House approval on Wednesday for a controversial plan to essentially manufacture several new barrier islands off his state with sand dredged from the sea floor. Louisiana has been hardest hit so far by the oil slick.

BP pledged to pay for the offshore sand berms to be built.

Jindal, a rising star in the Republican Party, has accused the government of being too slow to respond to the crisis, heightening the political pressure Democratic President Barack Obama has faced in confronting one of the key tests of his administration.

In Pittsburgh, Obama called for an end to oil company tax breaks in the wake of the spill and pledged to find Senate support for a bill to overhaul U.S. energy policy.

Last best hope

The last best hope of gaining some measure of control over the worst US oil spill in history was concentrated a mile (1.6 km) beneath the surface of the Gulf at the site of BP's catastrophic blowout.

The spill was unleashed on April 20 by an explosion that demolished the BP-contracted Deepwater Horizon offshore drilling rig and killed 11 crewmen.

After a fruitless three-day attempt to plug up the crippled wellhead with drilling mud, BP embarked late on Tuesday on a new strategy to curtail the flow of oil that has been escaping into the Gulf at the rate of up to 19,000 barrels (800,000 gallons/3 million litres) a day.

The latest plan calls for cutting away the leaking riser pipe protruding from the failed blowout preventer, then lowering a containment cap onto the remaining wellhead assembly to trap much of the escaping oil and funnel it to the surface.

The operation was expected to take 72 hours to complete. Officials have warned that the flow of oil could temporarily increase by as much as 20 percent between the time the riser pipe is severed and the containment cap is lowered into place.

BP does not expect to be able to fully choke off the flow until August, when two emergency relief wells are due for completion.

Meanwhile, the fragmented, far-flung oil slick posed a growing threat to several parts of the Gulf.

One of the first populated areas soiled earlier by tar balls from the spill, the popular Alabama resort town and bird sanctuary of Dauphin Island, was hit this week with a new wave of oil blobs that also started washing up in Mississippi.

"It's something we'd rather not have happen, but we all knew the possibility was there," Dauphin Island Mayor Jeff Collier said.

Toxic goo from the spill also crept to within 10 miles (16 km) of Florida's northwest panhandle, where officials said it could make landfall by Friday.

Tourism industry

Florida Governor Charlie Crist said his state has launched a massive advertising campaign, backed in part by $ 25 million from BP, aimed at bolstering a $ 65 billion-a-year tourism industry threatened by the Gulf Coast disaster.

"We understand what is happening and are doing everything we can to protect our beautiful state," Crist said.

In Louisiana, Jindal announced final approval from the Obama administration for a plan to build five large offshore berms with sand dredged from the sea floor to help shield the state's fragile coastline.

Critics have questioned whether the artificial barrier islands can be built up quickly enough to keep more oil from washing ashore. But supporters say the spill is likely to remain a threat for months and that the berms could prove crucial in holding back oil debris that would otherwise be swept inland by hurricanes.

US Coast Guard Admiral Thad Allen ordered BP to pay for the five berms, in addition to one he already approved last week. The oil company later said it supported the six projects and would pay the estimated $ 360 million cost to build them.

BP, which has lost one-third of its market value, or about $ 67 billion (46 billion pounds), since the blowout, saw its shares stabilize on Wednesday after sharp declines in London and Wall Street a day earlier. The sell-off was driven in part by the US government announcement that it had launched a criminal investigation of BP's role in the spill.

The outlook for BP was further clouded as the market barometer of the company's risk of defaulting on its debt hit a new high on Wednesday, reflecting growing concerns about BP's exposure to the mounting costs of the Gulf spill.

Credit default swaps protecting BP's debt jumped 87 basis points to a record 255 basis points, or $ 255,000 per year to insure $ 10 million for five years, according to Markit Intraday. By comparison, those swaps stood at about 100 basis points last Friday and 42 basis points in April.

The cost of insuring the debt of rig operator Transocean and Anadarko Petroleum Corp, which owns a 25 per cent stake in the blown-out well, also reached record levels on Wednesday.

Comments

0 comment