views

"All is fair in love and war and when it comes to the liquor industry, it is war."

This was an extract from a note signed by none other than the man they called the ‘King of Good Times’. It landed on the table of Ramesh Vangal, the Asia-Pacific head of liquor giant Seagram and Param Uberoi, the head of Indian operations. United Breweries Group Chairman Vijay Mallya was seething with rage. And there was a very good reason for it. This was the first time that his attempt to cobble together a joint venture (JV) with global liquor firm Seagram had been rebuffed. Back in 1998, no one would have dared to spurn Mallya.

You didn’t need to be an insider in the liquor trade to know that Mallya was powerful, politically well-connected and had a larger-than-life image. And what’s more, he often played rough, sparing no effort to snuff out his rivals. His two-decade-long duel with Manu Chhabria, a pugnacious self-made tycoon based in Dubai, was already a part of industry folklore.

And Seagram was clearly no match for Mallya in his home turf. He saw them as an opportunity to expand his portfolio with premium international brands like Chivas Regal. Mallya and Edgar Bronfman, the then CEO of Seagram Company, agreed to form a JV and talks began. And then Mallya laid down a condition: The JV would have to keep off the Karnataka and Andhra Pradesh markets, two of the biggest markets in the country. That prompted Seagram to stage a walk out.

In 2001, when French multinational Pernod Ricard took over Seagram globally, Mallya sensed another opportunity to strike. “He told Patrick Ricard, the chairman of Pernod Ricard, that it is difficult to survive without a local partner,” says a senior executive from the industry. By then, something unusual had happened. Param Uberoi, the head of Seagram India had been picked to head Pernod’s Indian operations, even though he belonged to the acquired entity. When Ricard asked Uberoi for his opinion, he was clear: We can do this alone, he maintained. Mallya backed off, but only for a while. Two years later, he was back with another JV proposal. This time, while Uberoi was ready for a partnership, he refused to bring Pernod Ricard brands under the JV. “His logic was that Pernod Ricard brands were doing well by themselves in India and it was UB brands that needed help,” adds a senior executive from Pernod Ricard. Finally, Mallya’s perseverance broke down and he never returned. The war now shifted to the streets.

The Battle Royale

For the last 10 years, the battle royale between Vijay Mallya and Param Uberoi has perhaps been one of the few untold stories of the decade. When he took over as CEO of Pernod Ricard in India, Uberoi inherited a loss-making business that was no more than half a million cases. Some of his brands were beginning to see traction, but they paled in comparison to the size and scale of Mallya’s brand portfolio. Pernod didn’t have the distribution reach nor the production facilities.

Mallya already had a large stable with at least six brands that were selling more than a million cases a year. His beer brands had nearly 50 percent market share. Mallya was acquiring breweries and distilleries around the country to build a strong manufacturing presence. His spirits business was scattered under many companies, which were already doing 25 million cases in 1999. In 2000, Mallya set in motion a plan to bring all the companies under United Spirits (USL). And by 2005, with Shaw Wallace under his belt, Mallya was the undisputed numero uno in the country. And even today, he loves tom-tomming that USL is among the world’s largest spirits selling company by volume.

There’s, of course, a rather large fly in the ointment: Mallya’s USL is no longer the most profitable spirits company in the country. Last year, it lost that place to Pernod Ricard India (PRI). The privately-held Indian subsidiary of Pernod Ricard doesn’t reveal its financial figures. Yet, executives within and outside the company confirm that the firm generated net profits of ‘around Rs. 500 crore’ for 2010, higher than USL’s Rs. 403 crore.

There are two other data points that make for an intriguing read. Pernod Ricard’s revenue of over Rs. 3,000 crore is just half of USL’s Rs. 6,422 crore. And it sold 20 million cases of spirits in 2010, a little less than one-fifth of what USL sold.

Today, Mallya, the businessman-politician, finds himself in a spot of bother. Each of his major businesses under the UB Group umbrella, including USL and Kingfisher Airlines, is under mountains of debt. USL alone has debt of close to Rs. 6,000 crore on its books. And the spirits company, Mallya’s cash cow, is facing increasing pressure.

By the end of this year, its flagship product, Bagpiper whisky, risks losing the slot of India’s and world’s largest selling spirit brand to Officer’s Choice, owned by friend-turned-rival Kishore Chabbria’s ABD Distillers. Chabbria is the chairman of ABD and had roped in Deepak Roy as the CEO, after he parted ways with Mallya.

More worryingly, neither the industry nor the investors now seem to put much value to USL’s huge annual sales of 116 million cases. “What is the point of calling yourself the largest in the world, if you don’t have profits to show for it,” says Nikhil Vora, managing director, IDFC Securities, who earlier this year downgraded USL’s stock to neutral. Detailed questionnaires sent to Mallya and USL went unanswered.

Things might only get worse from here for Mallya. Most folks within the industry back Uberoi and his team as the one better placed to tap into the fast growing Indian liquor story. The domestic spirits market is the second biggest in the world and the largest for whisky. The silver lining: The premium segment of this market is still pegged at only 20 percent, but is growing at a rate of 25 percent, much faster than the 16 percent growth in the low-price, high-volume segment that USL dominates. Not only is the average age of tipplers coming down, many of them have more disposable income and choose to be associated with bigger, better known brands.

Rivals have considerable praise for Pernod’s stellar performance under Uberoi. “I have a lot of respect for what Pernod Ricard has done in India. They have consistently put top dollar behind their brands and have fought the competition not on price, but through innovative marketing strategies,” says industry veteran Deepak Roy, vice-chairman and CEO of ABD Distillers.

It isn’t just about marketing chutzpah, though. Pernod Ricard’s success stems from a series of leadership calls that its CEO Param Uberoi took for over a decade. At its core, it involved challenging the status quo — and not once succumbing to the pressures of conformance.

Now, for most part, the liquor industry in India still remains a hotbed of political intrigue, regulatory snafus and intense competitive intensity. And it clearly isn’t a place for the faint-hearted. Uberoi simply stuck to his agenda. Through all the muck-raking and mud-slinging, he cut himself off from the rest of the industry. He never attended industry meetings, never gave media interviews (you’re unlikely to even find a solitary image of him on the Internet) and merely let his brands do the talking. He even chose to side-step political landmines by avoiding entry into corrupt yet large, government-controlled liquor markets in Tamil Nadu and Kerala. His decisive leadership eventually allowed Pernod to pull the rug from under Mallya’s feet.

But now, the game could start to change once again. In June this year, Uberoi surprised his colleagues and the rest of the industry by choosing to hang up his boots as CEO and bringing back someone he had hired 13 years ago — Mohit Lal — from Pernod’s operations in Ireland.

His friends have complimented Uberoi for his ‘courageous’ decision. The timing was perfect, his friends told him. “After having led the effort for 12 years, the business is on a strong footing. We have the most profitable brands and are the most profitable company in the industry. In volume and share too, Pernod Ricard brands are leading in the segments and in most states where we operate,” explains Uberoi.

“I felt the time was right to step down from an executive role and allow a new generation of leadership to take the company into the next phase. While I am happy to lend a helping hand to Pernod Ricard, this allows me to devote my attention to other areas that interest me…and also chill a little,” says Uberoi as he runs his hands through his hair. He now sports a grey designer beard and the almost-shoulder touching silver locks are very much reminiscent of his flamboyant rival.

Even after retirement, Uberoi remains his reclusive self, spending the last few months catching up on lost sleep — four hours a day was the regime for over a decade — and also visiting his daughter at Stanford University where he “might pick up a course on psychology later,” and travelling across the country, including to Goa, with his wife, to spend quality time at their new sea-facing apartment. (After their decade-long duel, you can be sure that Uberoi isn’t about to make it on the guest list of Mallya’s famous parties at his sprawling Kingfisher Villa in north Goa.)

“It is going to be an interesting phase,” says Uberoi of the coming days. The former Voltas and PepsiCo veteran is now serving a two-year term as the chairman. While he has handed over the reigns to his successor Mohit Lal, Uberoi is “only a call away” and despite not being involved in the day-to-day affairs, is still plugged into the goings on in the industry and the company.

Inside Pernod Ricard India’s corporate office in Gurgaon, there’s an apparent calm, but the underlying buzz is palpable. “They are not a company that you can take lightly,” says a senior Pernod Ricard executive, on conditions of anonymity, about the competition from the giant in Bangalore. “They are formidable, swift on feet. But we believe that the best man should win and the consumers should decide the winner,” he adds.

Mallya is losing no time to use his shock-and-awe tactics. The veteran of many a war raised the pitch a few months ago through his tweets on Twitter after an ad campaign by his company caught everyone’s attention. A McDowell’s ad showed Indian cricket captain M.S. Dhoni ridiculing a character similar to his Indian cricket teammate Harbhajan Singh, who turns out for Royal Stag, a brand owned by Pernod Ricard. Already, the more profitable of the two, Royal Stag, is poised to overtake its rival USL brand in volumes next year. (Interestingly, Dhoni used to endorse Royal Stag before he moved on to the rival camp on a record multi-crore endorsement deal.)

But Uberoi refused to pick up the bait and Pernod Ricard remained silent all the while, even as Mallya took digs at Harbhajan through his tweets, before pulling out the ad after Harbhajan’s mother threatened to sue him.

Nerves of Steel

There’s perhaps no better place to develop such nerves of steel than to work in a ballsy startup. Uberoi spent almost a decade in PepsiCo, as part of the team that launched the iconic beverage in India, before signing up as group chief financial officer for Seagram’s Indian business. Spirits was one of the two main businesses for Seagram, which also had a huge presence in entertainment through Polygram and Universal Music. Though the company had started selling its iconic international spirits brands like Chivas Regal in India, Seagram’s focus was to develop premium local brands and had introduced Royal Stag whisky in 1995.

Mallya, on the other hand, was in the middle of a protracted war with Manu Chhabria of Shaw Wallace across both the beer and the spirits markets. The fight was most intense for the high volume, low margin segment. “The market was almost equally divided between the two companies. The competition was intense and sometimes cut-throat,” recounts Deepak Awatramani, a Mumbai distributor who used to distribute brands of both the companies.

In 1998, soon after Seagram rebuffed Mallya’s overtures, Uberoi was asked to take over the spirits business as CEO. The business was losing Rs. 40 crore a year and had volumes of less than half a million cases a year. Uberoi was among the first non-sales chief executive of a liquor company in India. While this meant he was more focussed on earning profits than driving volumes, his FMCG (fast moving consumer goods) background ensured that he chose a very different route to rebuild the business. During those early days, Uberoi’s decisions were first ridiculed by the industry, but as they bore fruit later, elicited respect and cemented his legacy.

First, he changed the top team. “The focus was to align the team to a common vision,” says Uberoi. If anyone didn’t share that vision, they were replaced. Uberoi roped in Mohit Lal, who was at confectionery giant Perfetti as the CFO; got a new manufacturing head and till 2001, took care of marketing himself. Later, Sumeet Lamba was roped in from Dabur and only the sales head, Rakesh Vasishta who was in the UB Group, came from the liquor background. “I suspect, a lot of other industry players may have laughed at us for this kind of a mix,” Uberoi recalls with a smile.

Structurally, Seagram’s operations in India were divided into four regions, each a profit centre in itself. Uberoi increased this to six. “Aside from the sales head, we added marketing and finance heads to sharpen ground level actions and decision making capabilities,” says Uberoi. And then the finance whiz did something that was unheard in the industry. He forbade his sales team to cut prices of the products. “Royal Stag was the first grain-based whisky in India, whereas till then local whiskies were made from molasses. It was a premium product and we decided to play that up. And price is a good indicator of the quality,” says Mohit Lal, the then CFO.

On the production side, Seagram had just one bottling unit in Uttar Pradesh, from where bottles were trucked across the country. That pushed up logistics costs. Uberoi went about increasing the access to more bottling units across the country, and also set up distilleries.

These steps saw Seagram double its turnover and sales within three years. By 2001, it had wiped off the losses. And Uberoi’s progress immediately appeared on the radar of its most formidable rival in Bangalore.

On a High

French multinational Pernod Ricard had entered India in 1996, but waited another four years before it launched its first two products — Santiago rum and Tilsbury whisky. The two had a short life because within a year, in 2001, Pernod Ricard acquired Seagram globally. “It is to the credit of Pernod Ricard’s decentralised business model, that even after the acquisition, the company was called Seagram India till 2007. The focus remained to develop local brands as Pernod Ricard’s international brands had limited opportunity outside Duty Free and large hotels owing to absence of state policies and prohibitively high duty rates,” says Uberoi. In an unusual move, Uberoi was chosen to head the Indian business even though he belonged to the acquired company’s operations.

Before Uberoi could begin the second innings, there was a ‘surprise visitor’ in Vijay Mallya. The fact that talks again broke down with Mallya may have been a blessing in disguise. Over the next few years, Uberoi shifted gears to build on the foundations set in place three years before the Pernod Ricard acquisition.

The key was revving up the brands. “In the Indian alcohol industry, you either give an image per rupee or a kick per rupee. Before Pernod Ricard came in, it was mostly kick per rupee. They changed the rules of the game,” says Santosh Kanekar, an industry veteran turned consultant.

But it wasn’t without its challenges. Through the years, USL had built a strong relationship with distributors, first under Vittal Mallya and then under his son Vijay. Mallya leveraged this strength to build volumes, pushing distributors to drive stocks, giving discounts and sometimes asking distributors, who also had retail outlets, to push USL products in their shops.

Once it became clear that he wouldn’t be able to bring Pernod to the bargaining table, Mallya decided to go on the offensive. He asked his distributors to deal with only his products and drop all the Pernod Ricard brands. He also asked the retail outlet owners to stop selling the Pernod brands.

Simultaneously, Mallya flooded every bar and highway joint with Bagpiper and McDowell posters, glasses, ash trays and even table covers.

By then, Uberoi knew that they couldn’t match up to USL’s distribution strength. First, he carefully selected his distributors. He opted for the smaller players. “We didn’t have volumes initially and knew that the bigger distributors won’t push our products,” says a Pernod Ricard executive. So instead, Pernod salesmen, through the hand-picked distributors, focussed on not pushing volumes, but on ‘width’, or reaching maximum consumer points.

Moreover, as Kanekar says, “In India, due to advertising restrictions, you can’t show consumers how to use your product.” So, Uberoi’s team hosted tasting sessions in restaurants and clubs to introduce their products and sponsored musical events, including DJ nights. As awareness of the brands improved, volumes also picked up. Retail outlets, despite Mallya’s orders, started stocking PRI brands.

“Consumers wanted it and we didn’t want to lose consumers. Many a times, Pernod Ricard brands were kept under the shelf,” says a distributor in Mumbai who also owns retail outlets. So, even if all but one distributor dropped PRI brands on Mallya’s behest in 2005 in Mumbai, the popularity of Royal Stag and Blender’s Pride meant that Uberoi’s sales numbers were not affected.

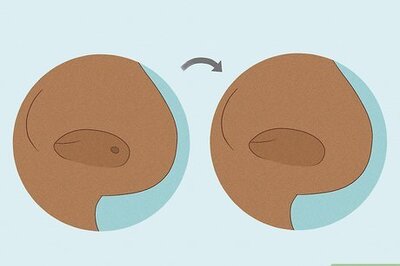

With economic prosperity, Indian consumers had become image conscious and Uberoi wanted to leverage that. In 2005, Uberoi hiked the price of Imperial Blue by 25 percent. Volumes tanked by 30 percent within six months. “But within a year we regained lost ground and started growing — on a more profitable basis!” he says. It reaffirmed his belief that consumers were willing to pay the price, provided the product quality was high and consistent.

The pricing strategy was complemented by a high-stakes marketing campaign. Royal Stag’s ‘Have you made it large?’ campaign with Saif Ali Khan, who was roped in as ambassador in 2004, touched a chord with the soaring aspirations of the new generation; Blender’s Pride’s fashion tour, now on for seven years, was a sustained drive that was built around lifestyle. In 2004, Pernod Ricard crossed the five million case mark and doubled it by 2007.

On the other hand, campaigns by USL’s Signature, which competes with Blender’s Pride in the same segment, was somewhat diffused in its focus, as it dabbled with golf accessories, the derby and also roped in actor Abhay Deol as its brand ambassador. “What makes it for Blenders Pride is the consistency,” says alcoholindia, a popular blog on the Indian liquor industry.

And managing a large brand portfolio posed its own challenges. When Mallya acquired Shaw Wallace in 2005, Royal Challenge was the biggest brand in the premium segment. But he already had Signature in that segment. Now with two brands in the same segment, the focus got diluted. By 2010, Royal Challenge’s volumes increased to 1.1 million cases. But that of Signature moved up to 1.2 million cases. And Blender’s Pride continued to rule the roost at 2.3 million cases.

Uberoi knew he had an Achilles’ heel though. “Political influence was something that our competitors had in plenty. They were big companies and had contacts. We were a MNC. This was not our strength and we wanted to keep away from it,” says a senior executive at PRI.

That meant not bowing to political pressure in appointing a distributor or giving a contract to a bottler or a distiller — Uberoi would never allow himself to be browbeaten.

That also meant keeping out of those particular states and therefore lose out on volumes — Pernod took the hit, for instance, in Tamil Nadu and Kerala.

Mallya, on the other hand, prospered and mastered the art of managing the business environment. He knew it was necessary if his company had to grow in a highly regulated industry. He was already close to decision makers and that proximity went to the next level when he himself became a Member of Parliament in 2002.

However, Uberoi’s call proved right. In 2010, Pernod Ricard crossed the 20 million cases mark and the chairman now expects to double that in the next three years. “We will double our profits every two-and-a-half years,” says Uberoi. Today, India is the biggest contributor in volumes for Pernod Ricard globally and is its fifth largest profit centre.

The New Frontier

Over the next couple of years, both Pernod and USL are likely to look to expand the premium segment. “While we will continue to drive our existing products, we are also looking to bring in more international brands from the Pernod Ricard stable,” Uberoi says. Mohit Lal hints that international brands like Jameson Irish whisky would see more focus. And vodka, the favourite drink of yuppies, will be an area of focus. “We will create more segments in vodka as we did in whisky,” says Uberoi.

Mallya, too, is losing no time to jump into the premium end. He’s already unveiled a premium light beer in Heineken. And in spirits, USL is looking to leverage its Whyte and Mackay portfolio. Last year, it launched McDowells Platinum and followed it up this year with Signature Premier, crafted by the Whyte and Mackay master blender Richard Paterson.

But USL’s skills in selling premium products are still unproven. “For years, USL’s team has focussed on driving volumes. Margins or profitability have not been the main priorities. For this to change requires a shift in organisational DNA and the company is yet to show that,” says Kanekar. As Vora of IDFC Securities points out, Mallya might have missed a trick or two by ‘under-pricing’ McDowells Platinum despite the new brand’s success.

Just before he stepped down, Uberoi further decentralised operations. From six, today Pernod Ricard has 15 regions-cum-profit centres in India. That, he says, will help focus better on consumer needs, improve fiscal discipline and respond to challenges faster.

Comments

0 comment