views

London: Britain's new finance minister Rishi Sunak will have to raise taxes rather than simply tweaking budget rules if he wants to ramp up spending in the first post-Brexit budget next month, the Resolution Foundation think-tank said on Monday.

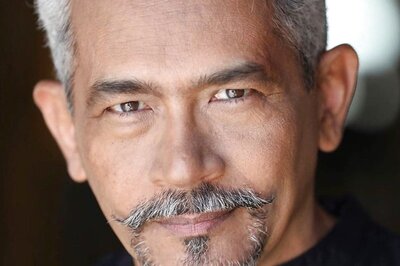

Sunak is due to announce the tax and spending plans of Prime Minister Boris Johnson's government on March 11.

His predecessor Sajid Javid unexpectedly quit less than two weeks ago, prompting speculation that Johnson wants to raise spending by more than budget rules set by Javid allow.

Johnson plans to help voters in struggling regions who backed him in December's election by spending more on infrastructure, a big shift for his Conservative Party, which for the past 10 years has focused on fixing the public finances.

"But new roads and rail lines are only part of the story," Resolution Foundation economist Jack Leslie said.

Johnson has also announced the biggest increase in spending on day-to-day public services in 15 years.

"Higher spending will require higher taxes," Leslie said.

Britain's fiscal forecasters assess each budget against fiscal rules that the finance ministry sets itself. Javid's rules aim to balance day-to-day spending against tax revenue within three years.

The Sunday Times reported that Sunak was considering pushing back that target to five years.

David Gauke, a former deputy finance minister who left the Conservative Party last year in a dispute over Brexit policy, said Sunak would be under pressure to show his independence from Johnson, given the circumstances of his appointment.

"It's not so much what Rishi does as what he doesn't do ... that there isn't a huge loosening of the fiscal rules. If I was him that would be my objective in this budget."

The Resolution Foundation said delaying balancing day-to-day spending would create only 15 billion pounds of extra fiscal firepower by the 2024/25 financial year, less margin for error than previous finance ministers have had at a time when spending demands are growing.

"The big question for (Sunak) is the extent to which he undoes big spending cuts to day-to-day public services, and how that is paid for," the Resolution Foundation said.

Gauke did not see appetite in the Conservative Party for higher taxes, and said even a modest further loosening of fiscal policy would set public debt as a share of GDP -- a key measure of fiscal sustainability -- on an upward trend.

This would be a historically unusual position for the Conservatives, and it would be dangerous to assume near record-low borrowing costs would last, he added.

"Markets tend to be forgiving until they are not. That might happen very quickly," Gauke said.

Sunak could increase tax revenues by cutting back incentives for private pension contributions, fixing loopholes in inheritance tax and reforming property taxes, the Resolution Foundation said.

There was likely to be some good news for Sunak as he prepared the budget -- reduced debt servicing costs from lower interest rates and inflation mean he will pocket a "a modest fiscal windfall" of 8 billion pounds ($10.4 billion) a year by the 2022/23 financial year, the Resolution Foundation said.

Comments

0 comment